Mobile virtual network operators (MVNOs) have experienced a slow start in the Middle East and Africa. However, Effortel, a mobile virtual network enabler (MVNE) that began life as an MVNO believes conditions may be right to see a rapid ramp-up of the offering in the region in the coming years

Andriulis warns that prospective MVNOs need to understand the market niche they intend to target, and that some of the most boring and practical matters are the ones that matter most

Effortel is a Belgium-based MVNE that was founded in 2005 and commenced commercial life through the launch of MVNO Carrefour Mobile (originally ‘1 Mobile’) as a 50/50 joint venture with the retailer Carrefour. Effortel further developed its technology platform before expanding into Italy, Poland, and Taiwan with similar retail-driven MVNO offerings.

“In 2008 we started to understand that we could leverage our technical skills and experience as an MVNO in order to also operate as an MVNE,” Liudvikas Andriulis, chief marketing officer of Effortel,” told Comm. “We now offer both technology as well as the ability to deploy MVNOs, together with the practical experience that comes with that.”

Andriulis says the company now has 10 MVNOs running on an end-platform that is based in Brussels, including three MVNOs in joint venture with Carrefour (Carrefour Mobile Belgium, Carrefour Uno Mobile Italy and Carrefour Telecom Taiwan), as well as providing MVNE services to Carrefour Mobile Mova and FM Group Mobile in Poland, Daily Telecom in Italy and Samatel in Oman.

In January, a company called BLADNA, which means ‘homeland’ in Arabic, announced the commercialisation of activities as an MVNO in Italy, focused on the North African community living in the country. The company, which is a subsidiary of Vodafone Egypt, said it would cater for the growing North African community in Italy comprised mainly of Egyptian and Moroccan nationals.

Planning, implementation and launch of the MVNO was accomplished in the space of two months.

Effortel is powering BLADNA, having gained enormous experience in the Italian market through the powering of Carrefour Uno Mobile and Daily Telecom, an ethnic MVNO dedicated to the Chinese community in Italy.

Effortel also has exposure to and experience in supporting Arabic, having been the MVNE behind the launch of Samatel in Oman in August 2010, which made the MVNO the fourth such player to launch in that market at the time.

“There are enormous benefits to be had from being able to operate several MVNO from a single platform,” Andriulis said. “I believe there remains a great deal of opportunity for MVNOs in the Arab world. We are looking forward to developments in Saudi Arabia in this respect, for example, and even beyond the Gulf region, markets such as Pakistan are of great interest.”

Andriulis said given Effortel’s experience with BLADNA in Italy, the company is quite comfortable with Arabic culture, and would be keen to generate more business from the geography, as well as from Arabic communities living in other parts of the world.

And while Effortel has ambitions to enter new joint ventures and markets, its performance to date has already been impressive. In the middle of February the company announced that revenue for its 2011 operations exceeded US$20 million to deliver a pre-tax profit of US$1 million. It stated the revenue growth had been driven by the strong performances of both Effortel’s MVNO business and its MVNE business unit, and that the company is now responsible for managing more than one million active subscribers across its 10 MVNO footprint spanning Europe, Asia and the Middle East.

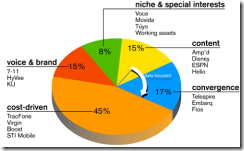

“MVNOs are definitely picking up, and we are seeing a lot of activity from non-telecom players looking to benefit from the opportunity,” Andriulis said. “Ethnical MVNOs are showing huge potential as are retail MVNOs, which are looking to extend the brand of the particular retailer further,” he added.

One of Effortel’s latest MVNO activities is the launch of FreeM – the first advertising funded mobile service to provide consumers with free data access. Based in Poland, FreeM is aimed at the ‘Facebook generation’, and is part of a prepaid MVNO that lets customers use a range of social networking, web and messaging platforms—including Facebook, Twitter, Wikipedia and Google—on their handsets completely for free.

In other parts of the emerging world Andriulis does perceive significant opportunity for MVNOs, though he warns that prospective players need to understand the market niche they intend to target, and that some of the most boring and practical matters are the ones that matter most in the success or failure of a venture.

“Some MVNOs in the Middle East are trying to take the mass-market approach, and I don’t believe that to be the correct one,” Andriulis said. “In Africa I see huge growth potential in 2013 and 2014, and I also believe a lot more can be done in South East Asia.”

Andriulis identifies success factors for MVNOs to include there being a strict cost control approach to all activities, while distribution is also of core importance.

“It is necessary to have a strong local partner, preferably one who already has distribution infrastructure in place that the MVNO can leverage,” Andriulis said. “Focus always works with MVNOs – a pan approach doesn’t often make sense.”

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment