The telecommunications industry faces declining revenues in developed markets and stagnating growth in emerging ones. Telcos thus need to tap into new sources of revenue growth, while reducing their cost structure. Big Data has been proposed as one of the industry’s solutions for both revenue growth and cost savings.

Santiago Castillo, Principal at Roland Berger Strategy Consultants

It has been claimed that Big Data could help tackle major human challenges such as cancer, hunger, and war. But does it hold as much promise for telcos as well?

The big bang of Big Data

Big Data refers to large, complex data quantities that are difficult to process. The term was coined in 2000 to mark the shift towards surging volumes of data, exchanged at high speed, and in a variety of forms. It is accelerated by the growing usage of social media and ubiquitous, connected devices (‘The Internet of Things’). Big Data solutions provider EMC predicts that the number of digital bits in the digital universe will grow by 40 per cent per year between 2013 and 2020 to reach 44 trillion gigabytes.

Big Data was enabled thanks to new solutions, such as Hadoop and MapReduce, which drastically reduced storage costs and increased processing speed. This was boosted by improved statistical methods as well as the rise of applications to apply these advancements to unstructured data. Big Data aggregates data across systems – from computers to sensors or meters – and leverages huge sets of data points in analyses to deliver unprecedented, accurate insights on customers’ behaviour that help improve performance and drive revenues.

The big deal for telcos

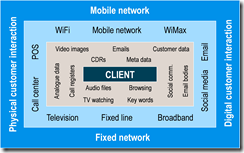

Big Data is an especially big deal for telcos that already harness vast amounts of structured data, including data on network usage, location, billing, and personal information. With Big Data solutions, telcos can also exploit unstructured data such as call centre transcripts and social media.

Leveraging Big Data can help growing telcos’ revenues by optimising pricing, improving targeting, and extending customer lifetime. It can also help reducing costs by enabling smarter spending. Given the margin squeeze that most telcos are facing, Big Data should be a board-level topic.

Some telcos, especially in the US, are already leveraging Big Data to drive revenues and reduce costs. Verizon Wireless, for example, uses anonymised data on customers’ surfing habits to sell to advertising partners. Its competitor AT&T created a Big Data powered tower-outage tool to better prioritise repairs of sites where customer experience was the most impacted. This initiative led to “59 per cent improvement in customer experience” according to the first employee of the company’s Big Data team. Spanish operator Telefónica has, in a similar fashion, set up its Dynamic Insights structure, which markets data and data insights to other organisations that can thus gain a better understanding of customers’ behaviour.

Illustration: The wealth of data available to telcos

The big market for telcos

The Big Data challenge is to translate the mountain of data into useful insights. Across the world, organisations are looking for solutions to achieve this. Major players, from software vendors to system integrators, have emerged and try to cater to the needs of the different actors in the booming Big Data industry. IDC, a research firm, predicts that the Big Data technology and services market will grow by 26.2 per cent annually between 2014 and 2018 to reach US$ 41.5 billion.

We have interviewed some of the main providers of Big Data solutions, and they all have case studies to prove that they can help drive value through Big Data in telecommunications. However, we gather that most of their work with telcos has not been conducted with key decision makers. In fact, senior management of many of our telco clients say that they are yet to see obvious positive returns on Big Data investments. This view is reflected in estimates by Forrester, a research firm, on usage adoption of Big Data solutions at just 10 per cent at the end of 2012.

We often find that Big Data is not even a big board-level topic. It is still in an early stage and, although case studies abound with proof of concept, it is so far a market primarily driven by Big Data solutions providers rather than telcos’ C-suite. We believe that this is a mistake. Telcos’ top management should guide the expenditure on Big Data as this market is set to grow significantly in the near future. Frost & Sullivan, a research firm, forecasts that Big Data-business in the GCC will grow nearly fivefold from US$ 135.7 million in 2013 to US$ 635.5 million in 2020.

The challenge to make it big with Big Data

Based on our work with clients, we have identified four key success factors that make Big Data work:

· Big Data requires C-suite support

Big Data is primarily driven by IT departments, partially because vendors are doing a good job pitching their solutions. But Big Data will only work if the ‘business’ departments (for example Marketing, Sales, Customer Care, and Network) leverage their business insight to ask the right questions and set Big Data objectives. Business and IT should approach top management together to convince them of the Big Data promise and build a strategy.

Our view is that many operators move slowly on Big Data. This is often driven by an incapacity to secure cross-departmental collaboration to overcome major roadblocks (for example, data protection concerns that require both IT and legal expertise). Companies that make Big Data a priority for the C-suite can ensure that the necessary stakeholders collaborate and establish a strategy for removing roadblocks.

· Big Data needs clear governance

Big Data requires telcos to rethink how they deal with data. Accountability for data management needs to be formalised, ownership attributed, and governance rules made clear to all internal stakeholders. In short, a company with Big Data ambitions needs a proper Big Data organisation.

Good governance, with clear Big Data leadership and ownership, would help telcos avoid facing the situation of one Middle Eastern operator, where two similar data analytics solutions had been procured in parallel by two different departments.

· Big Data depends on talent

Big Data requires people who are highly skilled in data management, data analysis, and data visualisation. Telcos’ data scientists should ideally also understand the business in order to identify Big Data opportunities.

Gartner, a research firm, predicts that one third of Big Data jobs will be vacant in 2015 due to lack of skilled resources. And without these Big Data experts, investments at any telco are at risk. For example, the lack of Big Data talents in Singaporean telcos led the government to invest in education in analytics as part of the Critical Infocomm Technology Resource Programme (CITREP).

· Big Data requires a supporting IT architecture

Big Data cannot be parachuted into an organisation. Companies that want to move ahead with it need to first redefine how they manage and organise data. Big Data also requires integration of structured and unstructured elements, together with supporting, analytical tools. However, the first steps do not necessarily require big capital expenses, as companies such as Amazon and Google offer relatively affordable, cloud-based Big Data solutions in-line with local legislation.

Linus Bruchner is Senior Consultant at Roland Berger Strategy Consultants

According to one senior manager at a European telco, one of the main reasons why his company was not moving faster on Big Data was its "impressive track record of failed IT investments" – a hurdle that smaller, pay-as-you-go solutions could help to overcome.

Although the returns on Big Data are not yet crystal clear, its potential is enormous. We believe that the question is not whether Big Data works, but how companies can make it work. Any telco, Middle East included, should act now and define its Big Data roadmap and adopt a step-by-step, learning-by-doing approach towards fully-fledged Big Data implementation to ensure that capital is well spent. Telcos that do not invest in Big Data now will be left behind by competitors that leverage it to grow their businesses.

This paper was prepared by Santiago Castillo, Principal at Roland Berger Strategy Consultants, and Linus Bruchner, Senior Consultant

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment