Nokia Siemens Networks is two years old and in that time has silenced early critics that the combination of Finnish and German corporate cultures would be a difficult thing to manage. Whilst the company continues to operate at a loss, its participation in the telecoms infrastructure and services space is growing all the time, and evidence of this success is no more evident than within the Middle East and Africa region

Nokia Siemens Networks headquarters in Finland

Nokia Siemens Networks headquarters in Finland

Nokia Siemens Networks (NSN) reported that gross profit decreased 17 per cent to €1.1 billion (US$1.46 billion) in Q408 to end-December, compared to the corresponding period a year earlier, with a gross margin of 26.1 per cent, down from 29.7 per cent. Overall the vendor reported an operating loss of €179 million as compared with a reported break-even operating result in the fourth quarter 2007, with a reported operating margin of-4.1 per cent.

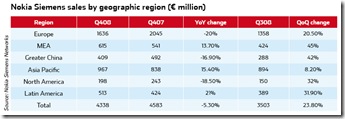

NSN’s Q4 results reflected the hardening marketing conditions as a consequence of the global recession, though the company’s overall undertaking for the entire year reflected a more robust performance. For 2008, net sales increased 14 per cent year-on-year to €15.3 billion in 2008. At constant currency, NSN reported net sales would have increased 20 per cent. Europe accounted for 37 per cent of NSN’s net sales, Asia-Pacific 25 per cent, Middle East & Africa 13 per cent, Latin America 11 per cent, Greater China nine per cent, and North America five per cent.

The results for NSN for 2008 are not directly comparable to the results for 2007, which include the results of Nokia’s former Networks business group for the first quarter 2007 and those of NSN from April 1, 2007 through December 31, 2007.

NSN recorded an operating loss of €301 million in 2008, compared with operating loss of €1.3 billion in 2007, with the decrease in operating loss attributed primarily to higher net sales and lower operating expenses and restructuring costs.

“There is definitely uncertainty in the market,” concedes Jan Cron, head of Middle East and Africa region of NSN. “But then there is also a view that customers can see the opportunities this uncertainty throws up. In some cases the stronger are becoming stronger while the weaker are becoming weaker, and there is a move to drive new revenues,” he adds.

Like other leading telecoms equipment manufacturers’ NSN is working to develop its services and advisory credentials in a much more relevant manner, and for the MEA region in particular, Cron believes the global economic downturn has given service providers the impetus to consider new business models.

“Customers are looking at the generation of new revenues. There’s a demand for subscriber data management and the creation of sticky services portfolios. Cost reduction solutions are also very relevant at this time as well as the motivations for a technology provider to take over the management of a network,” comments Cron. “All these topics and elements are now resonating much better as a consequence of the economic climate,” he adds.

Given its global reach, NSN has been able to foster deep relationships with customers looking to grow their regional and international footprints, and the proliferation of players harbouring such aspirations in the Middle East offers scope for significant take-up of its products and services.

The span of access technologies in the region is also converting into fertile ground for NSN, which has been tailoring its product portfolio in order to appeal to as wide a cross section of the market as possible. The vendor believes WiMAX technology will be popular as an alternative broadband data machine for TDD frequencies, while LTE will deliver truly broadband data and greater flexibility beyond 2010. WCDMA, HSPA, and HSPA Evolution are viewed as the mainstream broadband data and voice machine at this point in time, with GSM, EDGE and EDGE Evolution offering basic voice and data to a multitude of subscribers that still demand it across the MEA region.

“We are soon looking at the introduction of 3G in Pakistan, Iran and Algeria, for example, and for many, mobile Internet will be the first experience they will have to access the Internet,” says Cron. “At the end of last year NSN offered an outlook that the global market would shrink by around five per cent or more in 2009, and we are sticking to that guidance.”

According to Petri Moilanen, head of sales in the MEA for NSN, issues related to reducing the total cost of ownership are at the forefront of customers’ minds, and in much the same way that vendors are pushing services, NSN and others are also pushing the sustainability and green technology topic into the mainstream. The vendor has developed new site types wherein electricity consumption is minimised, or alternative ways to supply power are examined.

NSN forecasts that there will be five billion people connected on the planet by 2015, and this market of the future will be characterised by applications being predominately present on the Internet, the existence of a multitude of business models, and ubiquitous access to broadband. A number of industry challenges are thrown up as time passes and one of the main ones relates to connecting the next billion subscribers in the face of declining ARPU; the infrastructure and education challenge; first time Internet experience via mobile; and the extension of coverage for connecting rural areas.

“There is also going to be demand for greater bandwidth and a huge growth in data traffic over networks,” forecasts Moilanen. “There is set to be a 100-fold increase in traffic by 2015, though the growth in subscribers or revenues will not match that. This is as a result of bandwidth hungry applications, with a content explosion set to drive an exponential growth in traffic. Powerful new devices will also be introduced, driving data use as flat-fee subscriptions bring down the cost of data access,” he adds.

Another industry challenge identified by NSN, and which it describes as adding value beyond connectivity, is related to applications delivered using flat-fee data subscriptions; capturing new revenue sources (such as advertising and VoIP); and the reaching of critical mass of smart, open devices. The fact that the Internet is likely to be the main source of innovations also throws up new concepts with respect to the manner in which traditional telecoms providers will relate to that.

NSN believes the enormous hunger for bandwidth that will result in the 100-fold increase in traffic by 2015 is driving the development of fixed broadband access. This development and operators’ need for revenue growth are thus driving NSN’s investment in fibre-based next generation optical access (NGOA) technologies, amongst other things. The company also plans to limit its investment in existing Gigabit Passive Optical Networks (GPON) due to the fact that it believes the mass market roll out of fibre-to-the-home (FTTH) is unlikely in the short-term.

NSN plans to focus on DSL and NGOA technology and limit its investment in existing GPON. In parallel, NSN will develop NGOA technologies aiming to take a leading role in the future FTTH market. The vendor will also continue its fixed access investment in DSL by introducing new products addressing the increasing deployment of FTTC/B.

“The question of building relationships with customers and understanding their needs is crucial,” asserts Moilanen. “Our Professional Services unit offers advice on applications and within it has a substantial Systems Integration arm, so that we can help customers launch services such as IPTV, utilising DVB-H products, for instance.”

No one could have predicted how quickly or how deeply the global economy would retreat into recession, and from Cron’s perspective, NSN has been fortunate enough to have gone

through much of the pain of integration at the time of its formation two years ago. Thus the difficult decisions required to effect a successful integration and consolidation process have been ongoing, and he feels the company is well-placed to weather the current market conditions.

“We feel better prepared to rise to the current challenges and it has in fact been helpful that we took the steps we did two years back,” Cron suggests. “I am positive that the uncertainty that we see at the moment will move to a period of regained trust, and having weathered this time, we’ll be in an even stronger position moving forward,” he adds.

NSN clearly does not want to be viewed as just a hardware provider, and a number of its engagements in the MEA attest to its ability to offer highly regarded professional and managed services. Billing and charging is another area in which the company continues to build significant competence, as well as in processes related to customer relationship management, all packaged under the banner of value adding propositions.

“Our primary aim is to support customers. Gain their trust and then support their ambitions and plans,” Moilanen says. “Our aim is to have long and lasting relationships with customers and on both sides of the fence this typically ends up being the most beneficial.”

Cron points out that NSN does not believe in having a culture of a strong headquarters, rather it looks to empower offices and staff in-country to drive the business. The company conducts business in 45 of the 68 countries in the MEA region and where it conducts business, it has its people present.

Left: Petri Moilanen says it is clear NSN wants to be more than a hardware player, and is making good progress in the offer of managed and professional services

Left: Petri Moilanen says it is clear NSN wants to be more than a hardware player, and is making good progress in the offer of managed and professional services

Right: Jan Cron, head of ME A region for NSN, believes the company’s integration and consolidation programme has place it in a good position now

Acknowledging that the competitive landscape is tightening all the time, Cron and Moilanen remain confident of NSN’s market position; believing the company’s main differentiators include its portfolio of products and services, its approach, and the interaction it has with its customers.

“We are in the region to stay, and that statement is backed up by the in-country personnel we have here. This is a competitive market, so sure, there is some business you win and some business you lose. We have won more business than we have lost,” Cron asserts.

click to enlarge image

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment