Etisalat has made a habit of paying big for greenfield opportunities in large markets, and to its credit, has always gone on to justify the significant up-front fees it has agreed to pay. Having been picked as the winner of the third mobile licence in Iran, Etisalat has again offered top dollar for the opportunity, and it now remains to be seen whether the UAE operator can continue its run of making big business out of big investments

Iran is a country of 70 million, which has a mobile penetration rate in excess of 60 per cent and an industry ARPU of around US$9

Last month Etisalat confirmed it had been singled out as the winner of Iran’s third mobile licence, with a winning up-front fee amounting to US$402.1 million. Etisalat is set to pay a portion of this fee in line with its 49 per cent stake in the operator, and the new operator will then be granted a 15-year licence, with access to 3G spectrum for an initial exclusive period.

While the up-front licence fee appears relatively low as compared to recent fees levelled for similar licences in Egypt and Saudi Arabia, the revenue share arrangement that the new operator has to pay to the Iranian government over the life time of the concession is substantial. The new licensee has to fork over 23.6 per cent of its revenue to the government, which is a sizeable amount given the sums Etisalat plans to invest in the network, and the presence of two wellestablished players ahead of it in the market. Etisalat expects to invest between US$4-5 billion over five years in Iran, according to the telco’s chairman, Mohammad Omran. He forecasts that up to US$1 billion will be invested in the first year alone, and said financing the project would not be a significant issue given the telco has cash reserves of up to AED10 billion (US$2.72 billion).

While the licence agreement is yet to be signed, once it is and Etisalat becomes operational, it is looking to garner one million subscribers within its first 12 months of operation.

Five short-listed bidders were reported to have participated in the final stages of the licence award, namely Zain, Omantel, Bhahartiya of India, Malaysia’s Indocel Holding, and eventual winner Etisalat. The UAE operator is reported to have bid almost 50 per cent more than its closest competitor Zain for the concession with respect to the amount it pledged to pay to the government over the 15-year duration of the licence.

It has been suggested that Etisalat agreed that the amount it paid to the Iranian government over the duration of its licence would amount to no less than 80 per cent of US$5.6 billion, which amounts to US$4.48 billion. It is understood that in comparison, second-placed bidder Zain pledged to pay up to 80 per cent of US$3.8 billion (US$3.04 billion) over the life of the licence. Thus Etisalat’s pledge amounts to an annual payment of US$299 million in revenue share to the government, while Zain’s bid would have resulted in an annual payment of US$203 million a year for every year of the licence’s validity.

“According to Etisalat, the new operator is expected to launch operations in Q409 and spend US$451 million in the roll-out of its network in 2009,” stated a recent research note circulated by a financial institution in Dubai. “It intends to reach EBITDA and cash flow positive in 2011 and 2012, respectively,” the note continued.

Looking at the performance of second mobile operator MTN Irancell could give an indication as to whether Etisalat’s projections are achievable and whether or not the market situation has altered so drastically in the time since the second operator launched, that Etisalat will face difficulty in gaining momentum.

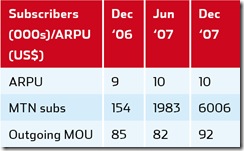

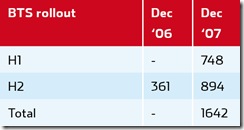

MTN Irancell launched official commercial services in December 2006, and by the end of 2007 had garnered a 25 per cent market share, representing just over six million subscribers. In the 12 months to December 2007, MTN Irancell generated revenues of R1.341 billion (US$195 million at a December 31, 2007 exchange rate), with EBITDA amounting to a loss of R180 million. After-tax loss amounted to R474 million in the 12 months to December 2007.

MTN’s earnings for 2008 are set to be released on March 12, and are likely to show a strengthening operational and financial performance, making the third entrant’s debut all the more challenging. MTN Irancell’s market share more than doubled from 12 per cent in June 2007 to 25 per cent at the end of December that year, with the operator having recorded 1.829 million net additions in H107, up to 4.023 million in H207.

By the end of September 2008, MTN Irancell’s subscriber base had risen to 13.139 million, up 13 per cent quarter on quarter, with ARPU averaging around US$9 per month. With an estimated 41.6 million subscribers in Iran at the end of 2008, and MTN Irancell enjoying a market share in excess of 30 per cent, Etisalat is likely to have to work very hard in order to provide additional value in the market and create a sustainable base of its own.

The second operator has been quick to anticipate the impact of the new entrant and has been consistently working to neutralise the effect of its entrance. MTN Irancell has introduced a number of loyalty generating schemes aimed at reducing the possibility of churn upon entrance of the third player.

Mobile penetration in Iran was estimated at around 60 per cent at the end of 2008, meaning the addressable market has narrowed sizeably since MTN Irancell launched in 2006. There have also been concerns raised with respect to geo-political overtures that may affect the way in which average Iranians accept the brand of an Arab operator given there has been a history of Arab-Iranian tension in the past.

It was not immediately apparent whether Etisalat would enjoy management control of the operation in Iran, though this is widely expected. Being in such a position would allow the operator to maximise pan-regional roaming arrangements and move closer to offering regional single rates akin to those offered by Zain.

Any business case would be challenging to support with US$300 million to be taken off the top every year, and while Etisalat is reputed to have deep pockets and being willing to stay the course, participation in the Iranian market is going to bring out the best in the operator for it to succeed.

The most significant single advantage that Etisalat holds is the award of 3G spectrum, permitting it to offer wireless broadband Internet access to a population that already has an appetite for Internet access. According to Iran’s communications ministry, the number of Internet users in the country stood at around 23 million at the end of last year, representing a 35 per cent penetration rate. Thus the offer of data cards and direct access to the Internet on mobile devices is likely to be popular and help generate Etisalat incremental ARPU.

Imagining a scenario in which the positive impact of broadband access raised Etisalat’s ARPU to closer to US$10 per month as opposed to the US$8-9 being generated by the two incumbents, this would equate to the total annual average revenues of 2.5 million subscribers in order to pay off the US$300 million annual revenue share to the government. It took MTN Irancell more than seven months to add 2.5 million users, and given Etisalat has forecast adding one million users within its first year of operation, it may take two years for the operator to reach that number of subscribers.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment