In November 2011, Nokia Siemens Networks (NSN) announced its strategy to focus on mobile broadband, customer experience management, and services, together with the launch of a massive restructuring programme that would include a headcount reduction of 17,000. Comm. spoke to NSN’s head of Middle East, Igor Leprince, regarding how these changes would play out in the region

Igor Leprince became head of Middle East for NSN effective October 1, 2011

Igor Leprince was appointed head of Middle East for NSN effective October 1,2011, replacing Jörg Erlemeier, who had been under mounting pressure following a challenging period for the telecom technology provider in the region.

“We have suffered from a delayed impact of the financial crisis,” Erlemeier commented in the middle of 2011, explaining the modest year-on-year growth in the Middle East and Africa achieved during Q111. “Access to funds (by network operators) in Africa had been tightened, but we can see more willingness to invest, and I believe we are back on the right track.”

Erlemeier’s prognosis appeared to be more-or-less correct, with NSN going on to report net sales increase of 11 per cent year-on-year to €14.04 billion (US$18.47 billion) for 2011. Operating loss for the year reduced to €300 million, down from €686 million a year earlier.

For Q411, the Middle East and Africa region continued to face challenging times, reporting a seven per cent decline in net sales from €423 million the previous year to €394 million in 2011. The Middle East and Africa region remained NSN’s second smallest geography in terms of net sales, ahead of North America.

“Mobile broadband is a key development in the region, and key markets such as Saudi Arabia, the UAE, Qatar, Kuwait, and Egypt are proving this,” Leprince told Comm. “I don’t think the ‘everything for everyone’ model is viable anymore. NSN is focusing more on innovation spend, with a view to being a leader in quality, which I believe aligns us very well with the Middle East,” he added.

Indeed, since the strategic announcement in November, NSN has moved swiftly in divesting non-core operations. Before the end of that month the company announced that NewNet Communication Technologies, a Skyview Capital portfolio company, was to acquire the former Motorola Solutions’ WiMAX business from NSN. Under the terms of the agreement, NewNet would acquire the complete WiMAX product portfolio, the related employees and assets, as well as active customer and supplier contracts. Approximately 300 NSN employees would transfer to NewNet, many of whom are based in Chicago and Hangzhou, China.

Then in December, NSN disclosed that ADTRAN, a provider of next-generation networking solutions, planned to acquire, through an asset sale and purchase agreement, the NSN fixed line Broadband Access business (BBA), and associated professional services and network management solutions. The planned acquisition would include the Broadband Access intellectual properties, technologies and the established customer base.

As part of this transaction, up to approximately 400 people, including engineering, R&D, sales and professional services employees, are expected to transfer to ADTRAN globally. The agreement also includes provisions that would allow ADTRAN solutions to be incorporated by NSN into its customer propositions, broadening ADTRAN’s business opportunities.

“In our three areas of focus – mobile broadband, customer experience management, and services – we are already a clear number two,” Leprince said. “However, being number two is not a differentiator in itself. I think the differentiation comes around innovation, and around quality, both of which are very important to us.”

Leprince said having held discussions with 15 of NSN’s top service provider customers on the region since his appointment, he has been reassured and inspired by the support and confidence the partners have placed in NSN’s evolving strategic direction.

“Our strategy made sense to them, and given that most of the revenue we generate from our customers is in the areas we are now focusing on, it makes sense to us as well,” Leprince said. “Our customers want a strong NSN in these areas – innovation and quality is important to them, and that is the reason we are doubling expenditure on quality.”

Leprince is confident that NSN products such as the Liquid Net offering will reinforce the company’s credentials for both innovation as well as quality. The suite of products and services, which include Liquid Radio, Liquid Core, Liquid Transport, and Liquid Net end-to-end Intelligent Broadband Management, are aimed at unleashing frozen network capacity into a reservoir of resources. This enables a broadband network to instantly adapt to unpredictable changes in end-user demand and boost the network utilisation.

Leprince believes NSN already possesses the scale and is differentiating around innovation

Liquid Radio helps eliminate the limitations of conventional radio access network architecture, while Liquid Core helps the core network to dynamically adapt itself to provide the capacity needed to ensure the best customer experience at the lowest cost. Liquid Transport is geared to help channel traffic along the path of least resistance through the network, while the Intelligent Broadband Management allows for the integration of traffic management and content management to create a more valuable mobile broadband experience while efficiently using the minimum network capacity.

The success of global telecom technology companies in the future will likely be hinged on their success in the burgeoning LTE space, and Leprince believes NSN’s positioning in the technology allows it to look to the future with confidence.

“We signed our 50th LTE contract last year, and seven of those fifty are in the Middle East region,” Leprince said. “This is a real milestone. Operators in this region want to be first, and customer experience management is also becoming an important part of that as one of the biggest drivers of churn is mobile broadband quality,” he added.

Leprince forecasts that 2012 will see increased LTE investment, and this ought to continue into next year, with NSN’s specialisation in the area set to place it in a strong position to take advantage of increasing traction.

In late February, for example, Indian cellco Bharti Airtel announced its selection of NSN to build and operate its forthcoming LTE network in Maharashtra, one of the country’s largest telecom circles.

The cellco in India will deploy its LTE network in the 2.3GHZ frequency band allocated by the Indian government for broadband wireless access technologies.

NSN will provide network design, integration, commissioning and optimisation services to the operator for rapid roll-out of the network, and a full set of services including hardware, software and competence development services. NSN will also use its Global Network Solutions Centre at Noida in India, which is already supporting TD-LTE networks globally, to remotely deliver services.

As part of NSN’s new strategy, the company also announced plans to reduce its global workforce, which stood at 74,000 as of November 1, 2011 by approximately 17,000 or 23 per cent by the end of 2013. The planned reductions are expected to be driven by aligning the company’s workforce with its new strategy as well as through a range of productivity and efficiency measures.

The planned measures are expected to include elimination of the company’s matrix organisational structure, site consolidation, transfer of activities to global delivery centres, consolidation of certain central functions, cost synergies from the integration of Motorola’s wireless assets, efficiencies in service operations, and company-wide process simplification.

The company has already begun the process of engaging with employee representatives in accordance with country-specific legal requirements to find socially responsible means to address these reduction needs. Leprince confirmed that the Middle East region would not be immune from the cuts, though he did not give any specific details on which markets would be most affected. NSN currently counts more than 3,000 staff in the region, as many as 80% of whom are indigenous to the Middle East.

“This game is all about scale,” Leprince said. “I would already argue that we have the scale and are differentiating around innovation; that we are clearly very innovative around customer experience management, and are leading edge there.”

NSN has been perfecting its customer experience management tools and insights for some time. Early last year, the company identified five user trends that it believed were shaping subscriber behaviour and in turn the direction that the telecom sector was moving in:

1. Broadband Internet is everywhere. In Africa it may be a little delayed but the trend is as important on that continent as it is in the Middle East and other regions

2. The personalised experience. Customers want to be treated like individuals using different services from an operator

3. Convergence is a topic that has been lingering for the last 15 years. But it is a fact now – access, devices, services, are all subject to convergence pressures. The need for simplicity is heavily affecting the way operators build their networks

4. Network and service quality is a must. Retention levers are very important. In a market that is predominantly prepaid, churn is just a click away

5. Flexible cost control and effective care. No one wants to be surprised at the end of the month with respect to the final bill

As such, at the heart of any effort by a service provider to understand and relate to its customers more effectively, a subscriber data management system is required whereby an operator knows the identity, location, device and services that are utilised by a specific subscriber.

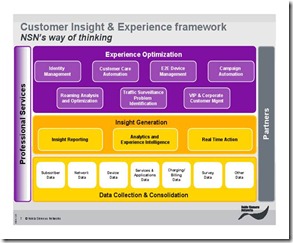

In order to help operators begin to successfully leverage a closer relationship with their customers and in so doing protect and improve their competitive positions, NSN launched its Insight & Experience Framework at the Mobile World Congress in Barcelona in February 2010. The framework is specifically aimed at giving service providers a powerful way to truly treat their customers as individuals. The framework lets service providers derive real-time, actionable insights from the wealth of customer data available across their networks.

The framework combines NSNs’ consulting and systems integration expertise with a set of software products that provide a wide array of data and insights about subscribers’ preferences and behaviour. Service providers can use the insights gained in this way to enhance their customers’ service experience and their own business performance.

“We are confident that we are making the right choices, investing in the right areas, and focusing on the right elements,” Leprince said. “Adding capacity to the RAN, developing the mobile broadband network, and driving quality overall are key propositions.”

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment