As the Middle East and Africa witnesses the highest growth in market value worldwide for communications, media and technology, analysts look to how telecoms players can maintain their momentum amid greater competition. Michelle Mills explores what factors are likely to be required in order to sustain business growth in the region in the years ahead.

Booz Allen Hamilton’s El-Darwiche says infrastructure sharing will reshape competitors’ relationships.

Booz Allen Hamilton’s El-Darwiche says infrastructure sharing will reshape competitors’ relationships.

Consensus among analysts and their market forecasts reveals further consolidation among pan-regional operators coming into play and increased competition from foreign markets. As competition heats up, cost optimisation will also encourage leaner business models which should modify traditional competitive relationships between operators.

Meanwhile, the high growth yet challenging market for regional broadband is set to see further investment, as deregulation and increased competition lead to continued activity by regional firms in the emerging markets.

Pan-regional consolidation

Global management consulting company Oliver Wyman affirms that operators experiencing slow growth in their mature home markets are looking to emerging markets as a source of revenue and earnings growth. UK-based Vodafone is a good example of this trend, having acquired positions in India, Africa, Turkey, and most recently in Qatar. Market liberalisation in the Middle East has opened the door for Asian, European and US companies hungry for exposure to emerging market growth potential, but it has also created a challenging environment for Middle East operators used to lower levels of regional competition.

Operators in the Middle East have also been aggressive in extending their own regional footprint into adjacent markets. When MTC Group (now branded Zain) acquired pan-African mobile operator Celtel International for US$3.4 billion in March 2005, the deal gave the Kuwait operator access to 13 African markets. Etisalat’s acquisition of Atlantique Telecom in April 2005 offered the UAE operator access to seven West African countries, while Qtel’s takeover of Kuwait-based Wataniya gave Qatar incumbent a foothold in seven emerging economies, including Algeria, Saudi Arabia, Tunisia and Palestine.

According to Delta Partners, a Dubai-based management advisory and investment firm, a strong source of competition in the MEA region will come from other high growth market players in China, Russia and India that are already making moves outside of their domestic markets.

“Reliance is making inroads into east Africa and Bharti Airtel is following suit in South Africa. China Mobile acquired Paktel and has a war chest of US$30bn,” analysts at Delta Partners point out in a recently published white paper entitled Identifying today’s key industry dynamics in the Middle East and Africa. “Russian operator Sistema acquired 10 per cent in Shyam Telelink in India and has expressed interest in the third mobile licence in Iran.”

And while foreign competitors are eyeing up regional opportunities in the MEA, regional heavyweights such as Zain, Etisalat, Qtel, Orascom Telecom and MTN Group are emerging as titans within their own geographies. Delta Partners says while these multinational operators are in the process of integrating their acquired operations in order to realise the synergies and economies of scale brought about by an expanded customer base and geographic footprint, they are not shying away from further expansion opportunities.

This continued thirst for development is driven by ambitions of becoming global leaders – and to avoid being swallowed up themselves by other global players.

Delta Partners predicts the consolidation landscape in 2008 will be characterised by scarcer opportunities in the region leading to several smaller deals where pan-regional players seek controlling stakes in single country operators across the region. The consultancy also foresees operators investing in minority holdings of larger players in adjacent regions such as south and eastern Europe, southeast and central Asia.

Leaner business models

While operators are realigning and restructuring their business models in the wake of group consolidations, more operators are viewing network and IT elements as non-critical activities that can be outsourced or shared. In mature markets, the increased competition is driving down prices and creating near-parity in network quality and coverage, meaning the network is a non-core function that is no longer a competitive differentiator. In less developed and lower income markets, the need to serve the lower percentile more efficiently is forcing operators to consider outsourcing parts of their network to help lower costs.

The two main outsourcing opportunities Delta Partners suggests will emerge are network outsourcing and managed services – including tower management, as well as the outsourcing of transmission to wholesale operators.

These opportunities for outsourcing high up in the value chain allow operators to pool network elements, focus on core functions, and boost business profitability. Delta Partners estimates an operator with 5,000 base stations, sharing 3,000 of these with another operator, has the potential OPEX savings of US$45 million or roughly 30 per cent of annual base station-related OPEX. With this scenario, the development of an additional 1,000 shared base stations gives a potential CAPEX reduction of between US$62.5-115m.

The new competitive landscape that includes operators such as fixed wireless access providers, Internet and data service providers and mobile virtual network operators, offers a growing opportunity for incumbent operators to complement their traditional retail business with the wholesale business of selling bandwidth, instead of viewing virtual operators without their own infrastructure, as a threat.

Oliver Wyman agrees network outsourcing is an important aspect for the creation of lean business models and optimisation of profit. In its study of the top 60 communications, media and technology (CMT) firms, the management consultancy firm found one of the three key characteristics that identified superior performers was that they all enhanced their operational excellence and lowered business risk by using a combination of improvements such as network outsourcing and workforce planning.

For example, Bharti Airtel built a successful organisation outsourcing its network deployment to Ericsson and Nokia, its IT services to IBM and its customer contact centres to Nortel. This resulted in savings in capital spending, as well as a drop in operating expenses as a share of revenue by eight per cent annually since 2003.

“Network sharing and outsourcing have become hot topics for key players looking to reap the benefits of lower operational expense sooner, lowering overall costs and increasing flexibility to handle changes in customer demand – making these kinds of firms formidable competitors,” Oliver Wyman advises.

Management consulting firm Booz Allen Hamilton also foresees infrastructure sharing deals as reshaping the relationship between competing telecoms operators, and accelerating the development of the market. In a recent study it produced on telecoms infrastructure sharing, Booz Allen Hamilton asserts that sharing is a key strategy for new revenue generation for telcos in the MENA region which optimises costs and can reduce capital expenditure components by as much as 40 per cent. “When looking at the case of two specific mobile operators in the MENA region, savings can amount to US$250m over a period of three years, should they decide to join forces in deploying their respective networks,” says Louay Abou Chanab, an associate in the communication and technology practice of Booz Allen Hamilton.

Different forms of infrastructure sharing are possible, ranging from basic unbundling and national roaming, to advanced forms like co-location and spectrum sharing. National roaming has been used extensively in Jordan, Morocco, Oman and the UAE, while unbundling is being led by Egypt and Saudi Arabia. Since local loop unbundling was enforced in Morocco last year, the broadband market is estimated to have grown by 19 per cent in six months.

Other forms of sharing are bound to develop, given the benefits to both incumbents and new entrants alike. Incumbents like Etisalat and Saudi Telecom can maximise their existing infrastructure and generate new revenue streams that can be channelled into their regional expansion plans, while new entrants will be able to focus on service offerings with limited rollout burdens.

Bahjat El-Darwiche, principal in the communications and technology practice at Booz Allen Hamilton, says the MENA region is quickly developing towards service-based competition, with countries like Jordan taking the lead, and Bahrain, Oman and Saudi Arabia set to follow shortly thereafter.

“Service-based licences allowing the introduction of virtual operators are expected over the course of the coming two years,” predicts El-Darwiche. “Hence, incumbents and other facility-based operators should gear-up for sharing their networks and host service-based operators.”

Spectrum trading on a commercial basis is also on the rise in Europe and it is expected that a similar trend will also surface in the MENA region in the longer term, due to the spectrum scarcity.

Broadband growth

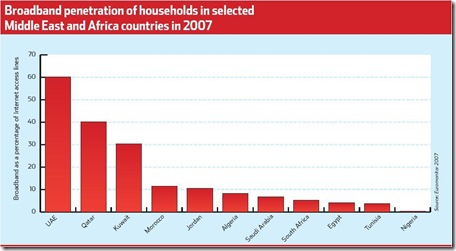

Another area in the communications sector identified as having high growth prospects in the region is the double- or triple-digit growth rates being experienced in broadband subscriber numbers, be it from a low base number. The broadband penetration rate for the MENA region in 2005 stood at just one per cent of the region’s population, offering exciting prospects for telcos hungry for their slice of the broadband pie. Penetration rates vary across the region at this stage, with countries like the UAE enjoying 60 per cent broadband penetration in 2007. However, challenges do still exist in raising usage further given slow market liberalisation in some countries, poor infrastructure and high prices.

“Despite these factors, the region’s number of broadband subscribers are expected to more than double over the next three years,” forecasts Hilal Halaoui, principal with Booz Allen Hamilton. “This is largely because of the increasing availability of broadband access channels, reductions in cost, and the enormous demand for broadband content.”

Booz Allen Hamilton’s study entitled Broadband in the MENA Region identifies five key factors driving the increased demand for broadband:

- The greater availability of, and demand for digital content;

- The burgeoning youth market;

- Increasing regional prosperity;

- Liberalisation of the market and increased competition;

- Network technology advancements.

Booz Allen Hamilton believes the vast majority of broadband access in the MENA region is expected to be delivered over DSL, providing a semi-monopolistic opportunity for regional telcos.

However, Delta Partners predicts the lack of fixed-line infrastructure has been one of the key inhibitors to widespread broadband adoption, and therefore mobile operators and emerging fixed wireless access providers in this region are now looking to leverage alternative wireless technologies. Cdma2000 1xEV-DO, WiMAX, UMTS, or HSPA are now being viewed as compelling alternatives for the delivery of a broadband experience.

At the end of last year, for example, Mobily in Saudi Arabia announced it supported over 100,000 active HSPA subscribers.

In more developed broadband markets, strategies are likely to focus on creating a value proposition that enables the previously unconnected to bypass dialup altogether and go straight to broadband use. Those that are currently connected are likely to be targeted by revamped offers that provide higher access bandwidths, up to 4Mbps, or in bundled offerings that combine Internet access, voice telephony and video, in an effort to raise ARPU and satisfy higher consumer demands.

Emerging market CMT sector creates strong value

Oliver Wyman singles out Middle East and Africa as a consistently high performer in its inaugural State of the Industry Report, published earlier this year, which analyses the performance of global CMT companies. According to Oliver Wyman’s Shareholder Performance Index (which compares shareholder returns by adjusting for the volatility of returns, differences in local interest rates, and mergers and acquisitions), the MEA has witnessed the highest compound annual growth rate of any region, at 72 per cent over the past four years.

Emerging markets witnessed the value of firms growing by an average of 38 per cent, while companies in developed economies grew by less than half that rate, at 15 per cent. India’s Bharti Airtel took top honours in the SPI performance, outperforming the average firm fivefold, while China Mobile edged out Microsoft for the number one position in terms of total market value with a market capitalisation of US$364 bn at the end of 2007.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment