Worldwide sales of mobile phones increased by 11.8 per cent in the second quarter of 2008 compared to the same quarter last year, bringing quarterly sales to 305 million units, according to a report by research and advisory firm Gartner.

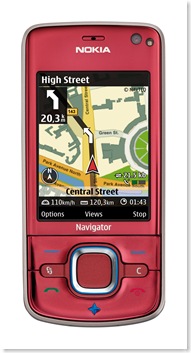

A lack of 3G and hot applications like GPS has kept Motorola’s sales lagging in the latest quarter, while Nokia continues to extend its market share dominance.

A lack of 3G and hot applications like GPS has kept Motorola’s sales lagging in the latest quarter, while Nokia continues to extend its market share dominance.

Nokia and Samsung further strengthened their positions as the number one and two-ranked handset manufacturers with 39.5 per cent and 15.2 per cent market share respectively.

However, only 2.5 percentage points or 7.4 million handsets, separated third-placed manufacturer Motorola, from fifth-placed Sony Ericsson. LG retained its fourth spot ahead of Sony Ericsson, which it overtook for the first time in Q108.

Gartner’s research director for mobile devices, Carolina Milanesi, noted that the economic environment continued to negatively impact mobile phone sales in both mature and emerging markets.

“Despite this, we remain positive that mobile phone sales in 2008 will reach 1.28 billion,” Milanesi commented.

The report attributed Nokia’s widening lead and high sales in the low-cost segment to an effective distribution strategy, economies of scale and brand power. Gartner expects Nokia’s diverse portfolio will continue to drive its market share in the latter half of 2008, and suggests its highly anticipated touch-screen device will be a mid-high-tier device rather than a high-tier, and this will help boost revenues.

However, for struggling Motorola, Gartner remains sceptical that revamping products such as the Ming “in response to the touch-screen frenzy” will resurrect its slumping sales. Gartner comments that Motorola’s portfolio remains uncompetitive because of its lack of 3G and hot applications such as GPS and high quality Internet browsing.

Worldwide mobile terminal sales to end-users in Q208 (thousands of units)

| Company |

Q208 Sales |

Q208 Market share (%) |

Q207 Sales |

Q207 Market share (%) |

| Nokia |

120,353.3 |

39.5 |

100,032.8 |

36.7 |

| Samsung |

46,376.0 |

15.2 |

36,211.8 |

13.3 |

| Motorola |

30,371.8 |

10.0 |

39,530.1 |

14.5 |

| LG |

26,698.9 |

8.8 |

18,522.9 |

6.8 |

| Sony Ericsson |

22,951.7 |

7.5 |

24,346.5 |

8.9 |

| Others |

57,970.4 |

19.0 |

53,959.6 |

19.8 |

| Total |

304,722.1 |

100.0 |

272,603.7 |

100.0 |

Note* This table includes iDEN shipments, but excludes ODM to OEM shipments.

Source: Gartner (August 2008)

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment