It’s not new that broadband technology is revitalising the fixed line business as operators look to cash in on the runaway demand for data. What is new is the ways in which service providers are adapting their business models in order to garner as many users as possible, and the alliances they are forming with content and Internet players in order to remain relevant in the data revolution

The annual Broadband Global Summit held in Dubai last month brought together stakeholders excited with the prospect of creating an ecosystem that would hopefully enhance their relevance in the developments to come, while seeing them generate significant additional revenues from the new services being introduced.

The annual Broadband Global Summit held in Dubai last month brought together stakeholders excited with the prospect of creating an ecosystem that would hopefully enhance their relevance in the developments to come, while seeing them generate significant additional revenues from the new services being introduced.

STC believes the essence of its continued growth and development is in following a blended business model in which it looks to retain ownership of the subscriber by means of delivering appealing value added services. The approach appears to be working for the Saudi incumbent, which witnessed a 280 per cent surge in broadband subscribers between 2005 and 2006, a 209 per cent growth rate between 2006 and 2007, and a 75 per cent growth rate between 2007 and 2008.

“We added 400,000 broadband subscribers last years, and in Q308 we witnessed an 87 per cent growth rate in broadband,” said Saad Dhafer, STC’s VP of the Home Business Unit. “We have a target to reach 7.6 million broadband subscribers by 2012. We have 1.6 million subscribers today, both wireless and wireline, and this month (March 2009), we announced we had one million fixed broadband subscribers,” he added.

Dhafer believes that from a user standpoint, it is virtually impossible to differentiate between wired and wireless broadband, and being a converged operator offers the advantage of being able to utilise the most economical access technology in order to provide service.

STC enjoys a 96 per cent share of the fixedline broadband market in Saudi Arabia, though this commanding market position is set to come under greater threat this year as two additional fixed-line players enter the market.

“In these competitive times, quarterly monitoring of trends is now becoming important,” Dhafer asserted. “Sticky bundles have to be created and operators need to become lifestyle

operators, not just traditional service operators.”

The customer premises equipment livebox is a key component of broadband development, according to Dhafer, who said STC established its broadband strategy based on innovation

and ubiquity. With reference to innovation, the telco looked to tailor the end-to-end customer experience, while offering broadband access in a wide an area as possible.

STC has thus deployed fibre-to-the-home (FTTH) in five neighbourhoods, while its mobile HSPA network covers Saudi’s three main cities completely. The telco has also utilised WiMAX

technology, primarily as a gap-filler, and Dhafer acknowledged there were challenges in coordinating the management of multiple broadband networks.

Dhafer also confirmed that given the multiple broadband platforms operated by STC, a measure of cannibalisation does occur, though he regards the amount as minor. Like many service providers and equipment manufacturers, STC is also looking at developing a media arm that will be responsible for managing the complex relationship manifest in

origination, integration and delivery of content. “STC’s media arm is set to be up and running soon, and the smarthome concept is also under development,” Dhafer revealed.

The rapid pace of real estate development in the Middle East region in general, and Gulf in particular, has offered significant opportunity for the integration of communications systems within construction projects. Real estate developers often look for a single point of contact to advise on communications matters such as community (health and security); home automation; data centres; and telecoms services: and the model has developed from providing services to a household, to providing services to individuals within that household.

The use of alternative energy is likely to play an increasingly important role in the real estate developments of the future

The use of alternative energy is likely to play an increasingly important role in the real estate developments of the future

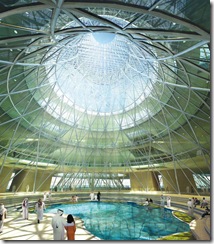

“Content is a key differentiator that a real estate developer wants to incorporate in smart developments,” commented Giancarlo Duella, head of Real Estate Consulting Services for Orange Business. “The Masdar development (in Abu Dhabi) virtually makes this region a leader with respect to green IT.”

There is a shift within the real estate space wherein developers in a sense are looking to become operators, though they do not possess a good concept of what is and is not allowed in order to do so, Duella determined. “There is often a lack of understanding with respect the operating boundaries in private environment versus those in a public one,” Duella said.

With respect to international examples, Telekom Austria is a telco that has significant experience in the broadband arena, and Austria as a broadband market is highly dynamic, with 38 per cent of all broadband connections added so far this year being HSPA subscribers.

Thirty per cent of Telekom Austria’s revenues are derived from data, which is in part a reflection of the country’s high laptop penetration rate.

“We have lost 700,000 fixed lines due to fixedmobile substitution, though telecoms operators still enjoy a two-thirds market share of the broadband market in Austria, said Erich Gnad, senior vice president M&A at Telekom Austria’s mobile arm Mobilkom. “Forty-seven per cent of the broadband market is in the fixed realm, with there being around 1.9 million broadband subscribers in Austria today.”

Around mid-2005 was the point at which the number of mobile minutes consumed in Austria exceeded the number of fixed-line minutes, with Gnad estimating that 75 per cent of minutes consumed in the mobile space has to do with the massive price war taking place amongst the country’s four operators.

Twenty-seven per cent of Austrian households are mobile only, with around 80 per cent of users covered by four cells in a typical day, thereby challenging arguments that in order to

be successful, broadband networks spanning large geographic areas are required.

“The driving success of broadband in Austria is the marketing of it,” said Gnad. “There are already 360,000 data cards in the market and we are adding more at the rate of 10,000 a month.”

Quick figures

197,090,443 population estimate for the Middle East in 2008

41,939,200 Internet users as of Mar.31/08, 21.3% of population

2,720,500 Internet broadband connections as of Sept.30/07, per IWS

1,176.8 % Growth rate in regional Internet usage between 2000 and 2008

Internet and broadband user numbers in the Middle East

Bahrain

Bahrain

Population: 718,306

Size: 694 sq km

Capital City: Manama

Manama popultion: 155,927 (‘08)

Internet users: 250,000 as of Mar/08

Penetration: 34.8%,per ITU

Broadband Internet connections: 38,600 as of Sept/07, per ITU

Iran

Population: 65,875,223

Size: 1,648,195 sq km

Capital City: Tehran

Tehran population: 8,070,230 (‘08)

Internet users: 23,000,000 users as of Mar/08,

Penetration: 34.9%, per ITU

Broadband Internet connections: 465,100 as of Sept/07, per ITU

Iraq

Population: 28,221,181

Size: 434,128 sq km

Capital City:

Baghdad population: 5,258,383 (‘08)

Internet users: 54,000 users as of Mar/08

Penetration: 0.2%, per ITU

Broadband Internet connections: data is not available

Jordan

Population: 6,198,677

Size: 89,342 sq km

Capital City: Amman

Amman population: 1,331,028 (‘07)

Internet users: 1,126,700 users as of Mar/08

Penetration: 18.2%, per ITU

Broadband Internet connections: 48,600 as of Sept/07, per ITU

Kuwait

Population: 2,596,799

Size: 17,818 sq km

Capital City: Kuwait City

Kuwait City population: 200,000 (‘08)

Internet users: 900,000 users as of Mar/08

Penetration: 34.7% per ITU

Broadband Internet connections: 25,000 as of Sept/07, per ITU

Lebanon

Population: 3,971,941

Size: 10,201 sq km

Capital City: Beirut

Beirut population: 1,295,078 (‘07)

Internet users: 950,000 users as of Aug./07

Penetration: 23.9% per ITU

Broadband Internet connections: 170,000 as of Sept/07, per ITU

Oman

Population: 3,311,640

Size: 309,500 sq km

Capital City: Muscat

Muscat population: 350,000 (‘08)

Internet users: 300,000 users as of Aug./07

Penetration: 9.1% penetration, per ITU

Broadband Internet connections: 15,200 as of Sept/07, per ITU

Palestine

Population: 2,611,904

Size: 6,242 sq km

Capital City: (n/a)

Internet users: 355,500 users as of Mar/08

Penetration: 13.6 % per ITU

Broadband Internet connections: 25,800 as of Sept/07, per ITU

Qatar

Population: 928,635

Size: 11,521 sq km

Capital City: Doha

Doha population: 600,000 (‘08)

Internet users: 351,000 users as of Mar/08

Penetration: 37.8% per ITU

Broadband Internet connections: 46,800 as of Sept/07, per ITU

Saudi Arabia

Population: 28,161,417

Size: 2,149,690 sq km

Capital City: Riyadh

Riyadh population: 4,453,447 (‘07)

Internet users: 6,200,000 users as of Mar/08

Penetration: 22.0% per ITU

Broadband Internet connections: 218,200 as of Sept/07, per ITU

Syria

Population: 9,747,586

Size: 185,180 sq km

Capital City: Damascus

Damascus population: 1,592,206 (‘07)

Internet users: 2,132,000 users as of Mar/08

Penetration: 10.8%, per ITU

Broadband Internet connections: 5,600 as of Sept/07, per ITU

UAE

Population: 4,621,399

Size: 77,700 sq km

Capital City: Abu Dhabi –

Abu Dhabi population: 1,000,000 (‘08)

Internet users: 2,300,000 users as of Aug./07

Penetration: 42.9% , per ITU

Broadband Internet connections: 240,600 as of Sept/07, per ITU

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment