In January 2009, when Cisco released its first Visual Networking Index, a forecast of data traffic in mobile networks, the first reaction from the market was incredulity.

Cisco was projecting that, based on traffic observed over the last five years, mobile data traffic was to double every year. Even more remarkable, video, then a mere 20 per cent of the overall traffic would rise and account up to 64 per cent of the traffic by 2013.

The industry met these projections with raised eyebrows and many dismissed the report as a simple attempt for vendors to sell more network equipment. While the intention behind the report is undoubtedly to bring carriers to the conclusion that they need to strengthen their network and prepare for huge CAPEX spending, the observations remain relevant.

By the summer of 2009, networks started experiencing data outages (AT&T). While the trend seemed to accelerate and spread (Verizon, Sprint, Vodafone Germany, Vodafone UK, O2 UK, Orange UK…), carriers and vendors alike started to look at identifying and defining the issue.

Patrick Lopez is founder and CEO of {Core Analysis} and has 13 years international experience in product and technology introduction

Mobile data indeed was growing fast and video seemed to be a large part of it. Additionally, the outages seemed caused by a variety of factors, from radio access network (signalling) to core (congestion) instability.

It is clear that the massive take-off of smartphones and tablets, coupled with the change in media consumption patterns by mobile subscribers had taken all by surprise.

The main cause, in my mind, for this surge and instability in mobile network traffic is not to be found in the technology but rather in the business model.

At the beginning of 2000, the wireless world is in ebullition. 3G licences are being sold for billions (with the UK auction the most expensive at £22.4 billion). Wireless operators embark on the promise of wireless Internet (WAP) and multimedia messaging. These promises were not delivered on, and many started to look for content and applications to fill their new-found bandwidth.

USB dongles proved popular for the enterprise market, to provide data connectivity on the go. Around that time, flat fee, all-you-can-eat, unlimited data packages start to appear. While there was not that much attractive content available, these plans proved effective in drawing throngs of subscribers and became a weapon of choice in the customer acquisition arsenal.

Fast forward to 2011 – with the rise of social media, the introduction of smartphones and tablets as new categories, the explosion of user-generated-content and the emergence of apps as the preferred way to access or interact with content in the mobile world – networks find themselves flooded with data usage.

While 4G is seen as a means to increase capacity, it is also a way for many operators to introduce new charging models and to depart from bundled, unlimited data plans.

Let’s look at some of the strategies in place for data pricing in a video world:

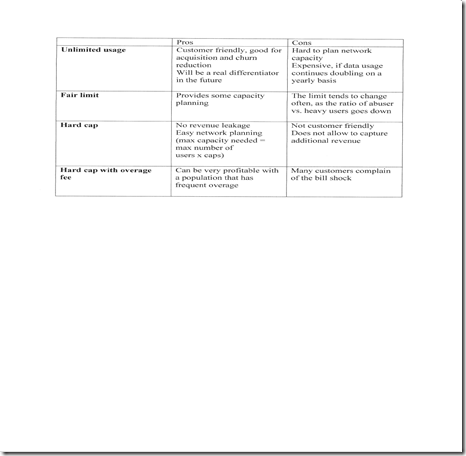

- Unlimited usage:This category tends to disappear as data demand increases beyond network capacity. It is still used by new entrants or followers with a disruptive play.

- Fair limit: even with unlimited packages, many operators tend to enforce a fair limit, usually within 90 per cent of their subscriber’s usage.

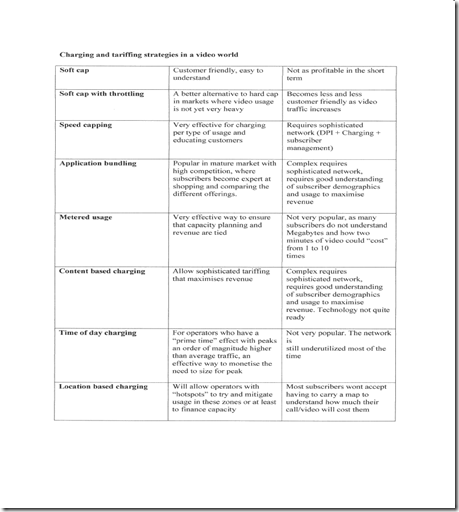

Charging and tariffing strategies in a video world

Capacity capping:this mechanism consists of putting a limit to the subscriber’s capacity to use data on a monthly basis. It is usually associated with a flat monthly fee. It is mostly a defensive measure. Past that limit, the operator has four choices:

- Hard cap:no data usage is allowed beyond the limit. The subscriber must wait for the next period to use the service anew.

- Hard cap with overage fee:Once the customer has reached his limit, a fee per metered usage is imposed, traditionally at a very high rate. For instance, €20 for 2GB and €1 per additional 10MB

- Soft cap:The operator introduces several levels of caps and usage and once a customer reaches a cap, he switches to the next one.

- Soft cap with throttling: The operator throttles the speed of delivery of data past the cap. Usually at a rate that makes it inefficient/impossible to use data intensive applications such as video. It is called as well “trickle-loading”.

Speed capping: As video, P2P and download usage becomes close to fixed broadband, operators have started to provide means to measure and charge for different speeds and usage. It allows them to create different packages for the type of usage

- Low speed for transactional (email)

- Medium speed for real time (social network, Internet music and radio)

- High speed for heavy use (downloads and videos)

Application bundling:This method consists of grouping applications or usage by bundles with individual tariffing schemes. For instance, free, unlimited IM, Facebook,

Twitter, Email at US$20 per month up to 2GB, no P2P…

Metered usage:This method consists of charging based on the amount of data consumed monthly by the subscriber.

Contextual charging:

- Content based charging:This is the target of many operators, being able to differentiate between the types of content, origin, quality and create a tariff grid accordingly. For instance: a pricing structure that will have different rates for HD and SD video, whether it is on deck or off deck, whether it is sport or news, live or VOD…

- Time of day charging: This is a way to make sure that peak capacity is smoothed throughout the day or to get the most margin from busiest times.

- Location based charging: Still embryonic. Mostly linked to Femtocell deployments.

As with many trends in wireless, it will take a while before the market matures enough to elaborate a technology and a business model that is both user-friendly and profitable for the operators. Additionally, the emergence of over-the-top traffic, with new content providers and aggregators selling their services directly to customers, forces the industry to examine charging and tariffing models in a more fundamental fashion.

Revenue sharing, network sharing, load sharing require traditional core network technologies to be exposed to external entities for a profitable model where brands, content owners, content providers and operators are not at war. New collaboration models need to be thought of.

Additionally, while the technology has made much progress, the next generation of DPI, PCRF, OSS/BSS will need to step up to allow for these sophisticated charging models.

About the author: Patrick Lopez is founder and CEO of {Core Analysis} and has 13 years international experience in product and technology introduction in the US, Canada, Switzerland, Ireland and France.

{Core Analysis} provides consultancy services to technology vendors, carriers and venture capital firms on mobile broadband, video optimisation, policy management and messaging.

About {Core Analysis}: www.coreanalysis.ca, http://coreanalysis1.blogspot.com/

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment