Tanzania is often overshadowed by its East Africa neighbour Kenya; the regional darling with respect to political stability and economic development. Tanzania’s telecoms sector is helping change this perception as a converged licensing framework introduced in 2005 helps the sector grow at a rate that is enviable not just in the region, but across the continent

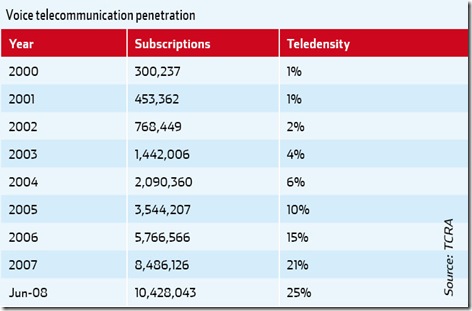

Tanzania has a population of over 40 million, and with a teledensity rate of just 25 per cent as of June 2008, is viewed as possessing strong growth prospects in the telecoms sector

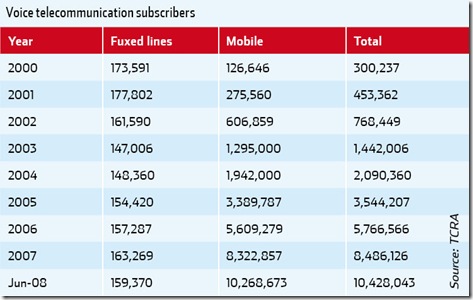

Tanzania is a country of around 40 million inhabitants, and prior to 2005 had teledensity of below 10 per cent. According to the Tanzania Communications Regulatory Authority (TCRA), by June 2008 this percentage had risen to 25 per cent, representing 10.4 million fixed and mobile telecoms users, and the growth rate has no sign of letting up.

Late last year the TCRA’s director general John Nkoma forecast that the number of phone users could rise to 13 million by the middle of 2009 with most growth coming from the growth in mobile communications. Government statistics show Tanzania’s telecoms sector grew by 20.1 per cent in 2007, and 19.2 per cent in 2006, developing a pattern of significant double digit growth.

Much of this explosive development of the telecoms sector can be explained by the market liberalisation that occurred in the sector during 2005 and led to the introduction of a Converged Licensing Framework consisting of four licences: Network facility; network services; application services; and content services. These four types of licences were offered in four segments: International; national; regional and district; and are technology neutral in nature.

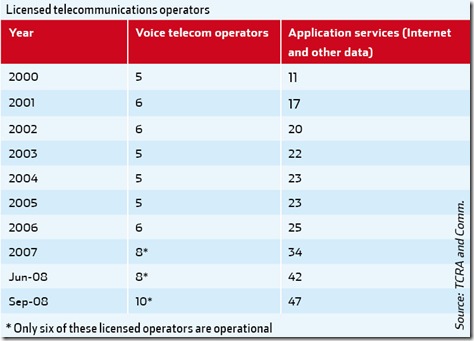

The TCRA describes the industry response to the updated licensing region as overwhelming, with the regulator receiving an unprecedented number of applications in the years since its introduction. The regulator prides itself with having licensed most prospective operators, and as of June 2008 there were eight licensed telecoms operators, six of which were operational. These were: Benson; Zain; Tigo (Millicom

International) Tanzania Telecommunications Company Limited (TTCL); Vodacom; and Zanzibar Telecom (Zantel, which is backed by Etisalat).

Late last year the director general of the TCRA announced the licensing of an additional two players – Mycell and Egotel – both of which are set to come to market during the course of 2009. Mycell has chosen cdma2000 1x technology to launch its services.

It is the regulator’s choice of technology neutrality that has led to the early introduction of innovations such as HSDPA and WiMAX into the Tanzanian telecoms arena much sooner than in many other parts of the continent. In 2007 for instance, telecoms provider Hotspot Business Solutions announced it was partnering with Canada’s Redline Communications Group to deploy a WiMAX network in Tanzania.

The first phase of the deployment started at the end of 2007, with Hotspot launching the service in the country’s commercial centre Dar es Salaam and Mwanza, with the rollout extended to Arusha.

The second phase of the Hotspot RedMAX deployment was slated to commence in January 2008, extending service to the capital city of Dodoma, Morogoro and Zanzibar.

Benson Informatics Limited began offering mobile service using CDMA technology in February 2007, while in March that year market leader Vodacom introduced HSDPA services, making Tanzania the second country in Africa after South Africa to launch the high speed network. In 2006, Vodacom South Africa pledged to would spend an additional US$126 million to expand its HSDPA network in Tanzania, bolstering its strong market position further.

Last April Vodacom also announced the arrival of the hugely successful M-Pesa mobile remittance service in Tanzania, from Kenya, where Safaricom in cooperation with Vodafone became the first operator in the world to utilise the platform.

In a similar manner that Safaricom enjoys a market share of above 80 per cent in Kenya, Vodacom holds a dominant market position in Tanzania, counting 4.52 million of the 10.26 million mobile subscribers in the market at the end of June 2008. The next largest operator is Zain, which counted 2.82 million subscribers at that time, then Tigo with 1.7 million users, Zantel with 1.07 million, and TTCL’s mobile unit with just 155,000.

As of September 2008, TCRA counted 12 network facility licences, 11 network services licences, and 47 application service providers, making Tanzania one of the most competitive telecoms markets in Africa. However, the regulator’s success in attracting new players is also a potential source of problems as licensees may find it difficult to deliver on what they promised.

The visit by former US president George W. Bush last February emphasises the international regard with which Tanzania is held, which is reflected in the amount of foreign direct investment occurring in the country

Hits Africa

Hits Africa, for example, is a licensee in possession of a unified licence. It had planned to launch last October, butto date has still not come to market. Last year the company’s CEO, Talaat El Lahham forecast the operator could garner some 600,000 subscribers in its first full year of operations, and said it would initially roll out 2G services for voice and SMS, with an initial investment in the network amounting to US$300 million.

Speaking to Comm. last year, Lahham explained that in Tanzania, Hits Africa possessed licences to offer GSM as well as WiMAX services. “We intend to launch first with a GSM network in the initial stages and at a later time we will rollout a WiMAX network for data services,” Lahham said. “We are looking to launch the GSM network before the end of this year. We have already selected the vendor for the network deployment – Huawei – and we have completed all the network planning,” Lahham added.

Unconfirmed reports from Tanzania suggest that Hits Africa has not been able to keep up with its payments for the rollout of the network, and that there is now a process underway to see whether an alternative investor, possibly from Russia, might be enticed to take over the investment in the licensee.

Vodacom Tanzania

Vodacom reported a tremendous 63.3 per cent rise in revenues for the six months to end-September 2008, to R294 million (US$35.3 million at the exchange rate as of September 30, 2008). Revenue was up by 34.8 per cent during the period to R1.5 billion, while the number of customers totalled 4.9 million, up 34.1 per cent yearon- year. ARPU increased just six per cent over the period to R53.

Zantel

As part of the TCRA’s liberalisation process, in March 2005 Zantel announced that it had received a licence allowing it to operate fixed-line and mobile telecoms services throughout Tanzania. At the time, Etisalat owned a 34 per cent stake in the operator, but increased this to 51 per cent in October 2007, acquiring an additional 17 per cent.

Zain

Zain Tanzania was launched in November 2001, and is currently held 60 per cent by Zain Group and 40 per cent by the Tanzanian government. As of September 2008 the operator claimed a market share of 36 per cent, representing a total of 3.285 million subscribers. This base represented a 46 per cent year-on-year increase, with revenues for the quarter amounting to US$86.5 million, an increase of 21 per cent. EBITDA increased by 38 per cent to reach US$33.9 million for the quarter to end-September, with net income reaching US$13.9 million, an increase of 29 per cent year-on year. ARPU amounted to US$9.

Zain Tanzania rolled out new services during Q308, including Jirushe and Jiachie bundle tariffs enabling customers to make unlimited on-net calls. Late last year Zain Tanzania was awarded a licence to install an international gateway. The operator promptly confirmed it would invest up to U$180 million in its network, and joins four other companies, including state-run TTCL, licensed to operate its own international gateway.

Dovetel

In March last year PME African Infrastructure Opportunities, the AIMlisted fund investing in infrastructure projects across sub-Saharan Africa, announced the completion of an investment in Dovetel Limited. Dovetel received ministerial approval on its national licence application to provide telecoms services country-wide. It is looking to deploy a fully-converged next generation (3G) network and aims to deliver high quality broadband, data and voice services throughout the country using CDMA technology.

Investment highlights:

PME agreed to provide Dovetel with up to US$26 million in financing in order to roll-out its 3G network throughout Tanzania over a two to three year period.

– PME acquired a 65 per cent shareholding in Dovetel.

– Dovetel signed a management service contract with TMP Management (TMP), a Norway-based arm of Telenor.

In June, the licensee issued a statement saying it would offer services targeted at both the business as well as the residential market. The licensee’s operating brand name is as yet undisclosed, though an announcement is expected early this year.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment