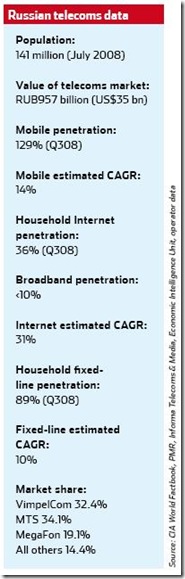

With more than 140 million people, broadband penetration of less than 10 per cent, and Internet and data revenues expected to grow 35 per cent annually, Russia’s broadband scene presents a sizeable opportunity for would-be investors. As the Russian Investment Roadshow stopped off in Dubai last month, Michelle Mills considers the elements involved in investing in Russia’s telecoms sector.

Russia is the world’s ninth most populous country, with a mobile penetration rate in excess of 120 per cent; making it one of the most dynamic mobile markets in Europe. However, 3G and mobile broadband services were only introduced in the country earlier this year by market leader MTS and third mobile operator MegaFon, and uptake has been strong with seven million subscribers having already been added during the course of the year. Internet penetration of households remains relatively low at just 36 per cent, with broadband penetration accounting for less than 10 per cent of the Internet market.

Non-voice revenues accounted for 14.5 per cent of total revenues of all Russian mobile operators in 2007, according to PMR, a European consultancy and market research firm. By 2012, PMR forecasts that income from 3G-based services will rise to 20 per cent of operators’ revenues.

Dubai-based telecoms consultancy and private equity company Delta Partners, has been early to capitalise on the opportunity to provide broadband Internet connectivity across Russia, having collaborated with Richard Branson’s Virgin Group to establish a broadband, voice and value added services provider known as Virgin Connect. The Russian operator is currently deploying a WiMAX network in 32 Russian regions including main cities such as Moscow and St. Petersburg.

“This is a positive investment for us since we came into the company at an early stage and so far the investment thesis has been confirmed,” stated Kristoff Puelinkx, managing partner at Delta Partners.

Puelinckx believes the Russian communications market offers huge potential given the latent demand for high-speed Internet access across the country, and the low service levels of existing providers. This has resulted in a huge opportunity for growth and Puelinckx believes wireless broadband is highly suited to the Russian market.

“A lot of the fixed-line networks are old, often obsolete networks, not equipped to provide new data and broadband-based services. Neither fixedline nor mobile operators currently have the luxury to budget for extensive CAPEX investments as capital is limited. This is why smaller broadband operators like Delta Partners’ portfolio company Trivon have a great opportunity to build out their wireless broadband networks and take market share in the next couple of years when competition is expected to be lower and slower than what was initially anticipated,” Puelinckx commented.

Andrei Terebenin, vice president of corporate communications at leading mobile operator MTS, which serves over 62 million subscribers, agrees that data will be an important revenue driver in the immediate future and that MTS is investing heavily in mobile broadband and 3G services.

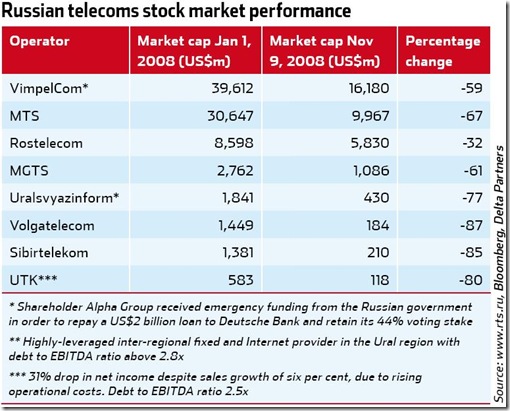

Before the brunt of the financial crisis, MTS’ market capitalisation stood at US$30 billion, but by early November this valuation had tumbled by 67 per cent to almost US$10 billion. Terebenin says that the operator’s priorities for the coming year will be to sustain its level of growth in the Russian market, while also considering international expansion and acquisition of financially distressed companies.

“We are becoming more experienced, we know how the synergy works, we are ready to extract more money for our shareholders, and I think prices will go down,” Terebenin stated. “Our two major criteria for investment are that market penetration should be quite low at less than 50 per cent, and that there should only be a certain number of players so that it is not too crowded.

It should also be a growing country and that is why we are looking mainly at Africa and South East Asia.”

Internet penatration of homes in Russia remains relatively low at just 36 per cent, with broadband penetration accounting for less than 10 per cent of the Internet market

MTS is not alone in its quest for overseas expansion. In late November, it was reported that VimpelCom, MegaFon as well as MTS were all in talks with Syria’s government over the offering of a third mobile licence. VimpelCom and MegaFon had also earlier expressed interest in the third mobile licence in Iran, of which the winning bidder is due to be announced within the next month. In July, VimpelCom signed a joint venture agreement to launch a GSM network in Vietnam and acquired a 90 per cent stake in Sotelco, a company holding a GSM licence in Cambodia. Meanwhile, MTS’ parent company Sistema upped its stake in Indian CDMA subsidiary Shyam Telelink to 73.71 per cent in June.

Delta Partners’ Puelinckx says the investors in Virgin Connect are open to analysing organic and inorganic expansion opportunities during the economic downturn, including the acquisition of smaller and larger players in Russia and the CIS (Commonwealth of Independent States), as well as “carve outs” of specific broadband operations out of larger players. To this end, Delta Partners is continuing to explore these opportunities and raise capital to fund such ventures.

Having studied the Russian telecoms market in some detail, Puelinckx warns that while there are many attractive investments opportunities available at the moment, new investors to the market will need a lot of nerve given the steep decline of Russian equities in recent months.

“Valuations are extremely cheap at the moment, with multiple valuations across sectors running as low as even two to four times earnings. Investors need to be wary in order to assure they bet on the right horses. The financial crisis has started to trickle down in the real economy, even though oil revenues and recent government intervention should be able to somehow buffer this trend,” Puelinckx said.

“Russia should be seen as a mid-term growth market, and as such, investors should focus on those companies that can be best positioned for driving and benefiting from growth in the sector,” he advised.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment