A senior telecoms executive from the Gulf region told me a few months ago that geographic expansion by service providers from the region was not a challenge in itself. He pointed out that the real challenge came in exercising constraint and pursuing such a programme in an economically efficient manner, ensuring that value could be maintained and created through the investment.

UAE mobile TV licence deadline extended to November 16

September 29th, 2008 — News

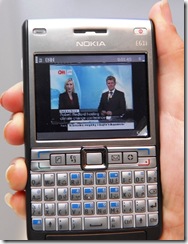

The UAE’s Telecommunications Regulatory Authority today announced the extension of the deadline for the submissions of proposals from parties interested in acquiring a single mobile TV licence on offer in the country. The new deadline has been established at November 16, having originally been set at October 19.

Both UAE providers have been piloting mobile TV services, however, only one licence will be up for grabs

Both UAE providers have been piloting mobile TV services, however, only one licence will be up for grabs

The mobile TV licence on offer in the UAE permits the successful bidder to roll out a mobile TV network and to begin offering transmission services. It will be allowed to sell the mobile TV transmissions to retailers in a non-discriminatory manner, acting as a provider of mobile TV service on a wholesale basis to retailers.

The cost of the 10-year licence amounts to AED17 million (US$4.7 million), together with an ongoing annual licence fee amounting to the higher of: one per cent of the revenues earned in a year; or AED100,000. The licensee will also be required to pay an annual royalty, equivalent of 30 per cent of its net profit before the royalty.

It is significant that the UAE TRA has opted to only offer a single mobile TV licence given that both incumbent operators in the country have expressed an interest in the service and have been piloting services.

According to the licensing conditions, citizens of GCC countries may hold up to 100 per cent of the shares in the mobile TV licensee. Investors from outside the GCC are however not allowed to hold shares in the licensee.

Etisalat breaks into India with US$900 mil. acquisition of licensee

September 24th, 2008 — News

Etisalat has finally gained access to the Indian telecoms market, having agreed to acquire a 45 per cent stake in Indian GSM licensee Swan Telecom, at a cost of US$900 million, Comm. can reveal.

Etisalat has spoken of its determined interest in entering the burgeoning mobile market in India for over two years, and the licensing of six new GSM operators in India earlier this year has proved the opportunity to facilitate the actioning of this long-held ambition.

Etisalat has spoken of its determined interest in entering the burgeoning mobile market in India for over two years, and the licensing of six new GSM operators in India earlier this year has proved the opportunity to facilitate the actioning of this long-held ambition.

India has a mobile penetration rate of around 30 per cent, leaving significant scope for further growth

Swan Telecom is owned by the DB Group, and the Etisalat acquisition again highlights the premiums willing to be paid by the UAE operator in order to enter markets it believes to be of strategic significance. Pan-Indian licences were offered earlier this year at a cost of approximately US$400 million each, and Swan Telecom was not even one of the bidders to acquire such a licence, paying a lesser amount for a concession that extended to 13 of India’s 22 telecoms districts.

Reports in India suggest Etisalat will look to acquire a controlling stake in Swan Telecom amounting to 51 per cent or more, at a later stage, as foreign ownership regulations in India permit foreign ownership of Indian companies up to a level of 74 per cent.

Swan Telecom, which is likely to go to market under the Etisalat brand name, is set to launch commercial services in the first quarter of next year, and the Indian licensee is reported to be in talks with incumbent operators with respect to infrastructure sharing.

Fixed-mobile convergence model pushed forward by Vodafone win

September 17th, 2008 — News

Indosat acquisition helps increase Qtel’s subscriber base four-fold

September 16th, 2008 — News

Having been forced to delay the announcement of its earnings for the second quarter for a number of weeks due to the effort to consolidate the results of recently acquired Indosat into its results, Qatar Telecom (Qtel) this week reported a 102 per cent growth in revenues in the first half of the year to end-June. Consolidated group revenue amounted to QAR8.11 billion (US$2.2 billion), while EBITDA increased 92 per cent year-on-year in the first half to QAR4.04 billion. This implies an EBITDA margin of 49.8 per cent for the period.

Qtel has a stated ambition to emerge as a top 20 telecoms operator by the year 2020

Qtel’s net profit attributable to shareholders stood at QAR1.18 billion for the first half, an increase of 33 per cent year-on-year.

The telco reported that Qatar, Kuwait, Iraq, Algeria, Oman and Indonesia (post acquisition) now represent its six largest markets by revenue, contributing 32 per cent, 19 per cent, 15 per cent, 10 per cent, eight per cent, and seven per cent of group revenue respectively.

The number of subscribers on Qtel’s networks increased drastically through acquisition, reaching 51.3 million at the end of June, up from just 9.6 million a year earlier.

With respect to quarterly performance, Qtel reported consolidated revenue amounting to QAR4.56 billion for Q208, up 78 per cent year-on-year, while its EBITDA margin slipped marginally from 50 per cent in Q207 to 49 per cent in Q208.

Net profit attributable to shareholders amounted to QAR654.5 million in Q208, up 59 percent from the same period in the previous year.

In Qatar, the telco reported revenue growth of 21 per cent for the half to end-June of QAR2.61 billion, and counted over 1.4 million mobile subscribers.

In Oman, Qtel’s Nawras operation reported revenues amounting to QAR609 million for the first half of 2008, up 63 per cent year-on-year. Nawras’ market share has grown from strength-to-strength to reach 44.4 per cent share at the end of June.

Qtel reported that Asiacell in Iraq counted 4.8 million subscribers at the end of June.