South Asia are predicted to decline by 50 per cent from current levels to 2013, forecasts a study by global consulting firm Oliver Wyman.

The study showed that while these regions are expected to contribute 44 per cent of new mobile subscriptions through to 2012, increasing competition, price reductions, and a second wave of low-income customers will drive average revenue per user (ARPU) levels from US$12 in sub-Saharan Africa down to US$6, and in India and neighbouring countries from US$6 to US$3.

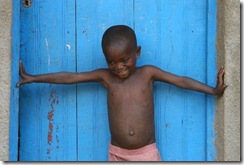

Operators in sub-Saharan Africa face a number of challenges, including comparatively high per-minute prices, high rates of illiteracy, and several countries with small populations

Obviously, adding more subscribers will generate further economies of scale. But scale alone will not be sufficient to sustain profitability and master the low-ARPU challenge,” said Joerg Hildebrandt, partner at Oliver Wyman in Dubai.

Hildebrandt contends that Indian operators are in a better position than sub-Saharan operators to meet the challenge because of high affordability of services, favourable wealth distribution, large economies of scale, stable GDP growth and extensive outsourcing and managed services.

On the other hand, in sub-Saharan Africa per-minute prices are comparatively high, high rates of illiteracy restrict the demand for SMS over voice, and across the region several African countries have small populations, political issues, language barriers and lack of affordable cross-border connectivity, which makes it difficult to leverage shared platforms between local operations.

To be able to continue to grow revenues with minimal decline in profits, Hildebrandt suggests African operators focus on sharing network infrastructure, building scale in back-office operations, further segmentation of the market to capture low-income users while protecting high-profit customers, and to streamline costs wherever possible.

“Just as few executives believed a decade ago that penetration of 2G mobile voice would ever go above two or three per cent of the population in emerging markets, it may be hard to envision a large market for mobile Internet. But it will eventually become affordable for more customers in sub-Saharan Africa as large subscriber bases in richer countries dramatically drive down the cost of network equipment and smartphones,” Hildebrandt concluded.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment