Omantel is entering a new era in its history, with the reintegration of previously spunoff Oman Mobile into the fold, and the introduction of a new corporate brand in the first quarter of next year. CEO Mohammed Al-Wohaibi details the strategic course the telco has embarked upon, which he believes will safeguard it from the ravages of competition, and outlines why redundancies – almost unheard of in the telco sector in the region – will help position Omantel for future growth and resilience. Michelle Mills reports

Mohammed Al-Wohaibi, CEO of Omantel

Mohammed Al-Wohaibi, CEO of Omantel

“Going forward, to be able to be transformed into a customer-centric organisation with high efficiency and effectiveness, some of the staff that have been with the company a long time may not be able to be transformed accordingly,” states Mohammed Al-Wohaibi in an exclusive interview with Comm.

“We are now working on a programme for them to exit the company. These people have contributed significantly to the organisation, they have not done anything wrong, it is the market change and process of liberalisation and competition. We would like these people to leave the company on good grounds and with dignity.”

The restructuring programme underway at Omantel is significant in many aspects, not least because it involves the consolidation and contraction of its human resources with those of subsidiary Oman Mobile. Al-Wohaibi believes the forthcoming job will help stabilise the company and position it for further growth in an increasingly competitive marketplace. Omantel is looking to transform from having been a sluggish government-run organisation, to entering 2009 as a more effective and dynamic operator. It has been a government entity throughout its 25-plus years of existence, having been part-privatised just three years ago through a 30 per cent public offering.

In an effort to realise future aspirations and build internal capabilities, the cultures of Omantel and Oman Mobile were analysed, and strategies devised on how to synergise operations between them. Through the review, a number of job vacancies arose and a recruitment drive is taking place to ramp up the new organisation, while the issue of excess staff in other areas of the combined company was also identified.

Omantel’s broader strategy of combining personnel and reintegrating mobile operator Oman Mobile back with the fixed business is to develop a more efficient business model. The service provider started the process of integration in February this year and is expected to be concluded by year-end. Oman Mobile currently commands 57 per cent of the mobile market, having faced aggressive competition since Nawras launched in March 2005.

“We have already launched the new business model. We call this a soft launch, where we have appointed new executives to their respective positions in the unified integrated structure. Oman Mobile still has legal obligations to continue as a legal entity until we get all the formal and regulatory approvals to finalise this integration,” he says.

“We have already launched the new business model. We call this a soft launch, where we have appointed new executives to their respective positions in the unified integrated structure. Oman Mobile still has legal obligations to continue as a legal entity until we get all the formal and regulatory approvals to finalise this integration,” he says.

Al-Wohaibi retains the mantle of CEO at the integrated company, while managing director of Oman Mobile, Amer Al Rawas, has been appointed chief commercial officer. Another 12 key senior appointments have been made.

Having spun off Oman Mobile in 2004 it seems surprising that in less than five years a process would be underway to reverse that decision and look to integrate the mobile operator within its parent. At the time in 2004, Omantel obtained a 25-year Class 1 licence, while Oman Mobile gained a similar 15-year concession. However, Al-Wohaibi believes reintegrating the mobile operator into the parent thereby driving synergies will position the unified operator to better compete in the future. According to Al-Wohaibi, several factors have influenced this decision including technology convergence, customer needs, regulation and cost efficiencies.

“Most of the technology today is moving towards next generation networks (NGN), IP and softswitches. These technologies are independent of mobile and fixed, whereas before you would have separate networks. As we improve our networks, NGN is an opportunity for us to converge and reduce the overall capital cost of our infrastructure, while positioning ourselves as a very strong unified operator,” states Al-Wohaibi.

With regards to customers’ needs, he says that as consumers become more sophisticated, they want to be offered services such as high speed broadband, regardless of technology or location. The operations of the unified operator will also be organised around the customer, with an active segmentation programme in place. Thus Al-Wohaibi also sees regional and international regulation moving towards a unified licensing regime, meaning operators will be able to offer services independent of the technology.

Another remnant from the past that will be refreshed is Omantel’s branding, colours and logo, which will better align the company with its future vision. Al-Wohaibi says there is still considerable work needed to be done, such as the rebranding of shops, but he expects the process to be completed early in the new year.

The rise of mobile resellers in Oman is a competitive consideration that Omantel will need to follow closely in the coming months, following the licensing of five Class 2 reseller players in June, and confirmation of a sixth licensee in October. The Class 2 licences permit the licensees to purchase bulk minutes from Oman’s two incumbent mobile operators, repackage them, and then sell them to the end-user. At the end of October it was confirmed that Friendi Mobile and Majan Telecom (also known as Reena) were the first two licensees to be awarded reseller licences by Oman Mobile.

The rise of mobile resellers in Oman is a competitive consideration that Omantel will need to follow closely in the coming months, following the licensing of five Class 2 reseller players in June, and confirmation of a sixth licensee in October. The Class 2 licences permit the licensees to purchase bulk minutes from Oman’s two incumbent mobile operators, repackage them, and then sell them to the end-user. At the end of October it was confirmed that Friendi Mobile and Majan Telecom (also known as Reena) were the first two licensees to be awarded reseller licences by Oman Mobile.

“We have gone a long way into these negotiations with the licensees. But we will not be able to carry all of them,” Al-Wohaibi states.

Meanwhile, Nawras’ chief executive Ross Cormack confirmed to Comm. that the second mobile operator has not reached an agreement with any of the resellers as no “win-win proposition” had yet been presented.

Al-Wohaibi is quick to point out that the service providers that reach agreements to acquire capacity from his network will face a tough road in gaining subscribers, and that the licensing of six resellers by the TRA is too many.

“In Oman we have about 90 per cent mobile penetration and we are growing so fast that within the next few months we will probably reach more than 100 per cent. The total population is less than three million, so the market to be addressed by the MVNOs (resellers) is going to be limited,” Al-Wohaibi predicts.

“I would say that a more prudent strategy would have been to issue two MVNO licences and then see how the market reacts. Maybe in one or two years’ time if the regulator wanted to introduce more competition, then issue a third or fourth licence. But to issue an MVNO licence to anybody who knocks on the door and fulfils minimum requirements? I think that is quite risky. We have to appreciate that throughout the world, failure of MVNOs is very high,” Al-Wohaibi asserts.

The days of Omantel’s fixed-line monopoly are also numbered with the Telecommunications Regulatory Authority (TRA) awarding the second fixedline licence to Nawras on November 18, conditional on the operator meeting the terms and conditions of the licence. The TRA’s first choice was the PCCW Awaser Oman consortium, but the decision was overturned shortly after, without the TRA stating why. Nawras has promised to build the latest generation fibre optic backbone and WiMAX wireless access network to deliver broadband telecommunications, Internet access and IP-based media.

In a pre-emptive move, Omantel plans to launch additional broadband services by the end of this year, as an add-on to its current broadband service with download speeds of up to 16Mbps.“Our plan is to capture the [broadband] market before the competition comes with services such as IPTV, video conferencing and video on demand. We are already there in the market and we have a customer base, we just need to build services on top of our broadband offerings,” says Al- Wohaibi. “We have an advantage in that we have a unified network for fixed and mobile; we can offer services across the board and can therefore add more value to the customer than just Internet and high-speed data services.”

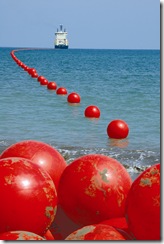

Omantel is investing in the Europe India Gateway cable system, enhancing connectivity

The appeal of IPTV and advanced broadband services in Oman, however, appears somewhat questionable, considering Orange Jordan launched IPTV services in September its home market and had only managed to garner 20 subscribers within two months. Jordan is viewed as a much more technology-savvy market than most in the region.

Oman’s fixed-line penetration stands at less than 10 per cent, with Internet penetration representing around three per cent of the population. At the quarter ending June-2008 Omantel (which incorporated Oman Mobile’s activities) recorded 1.6 million mobile subscribers, 279,000 fixed lines and 112,000 Internet users, of which 27 per cent were broadband subscribers. Al-Wohaibi believes there is great potential in the broadband market, which Omantel has not capitalised upon significantly, and with the entrance of premium services and future competition, he estimates Internet penetration could grow to 50 per cent by 2013.

In September, the distance dependency was removed from Omantel’s fixed-line tariff, as part of a broader review of the telco’s pricing proposition. The operator’s tariffs are now based on number of minutes as opposed to distance called, international call rates have been cut by 18 per cent, while fixed voice and ADSL are being combined on to one bill. Al-Wohaibi admits that the previous tariff system was confusing to customers, and that ironing out that process is a first step to being able to offer additional services and to become a more nimble operation.

“The old tariff regime was so restrictive, we weren’t able to give promotions and it was difficult for customers to understand how our tariffs were structured. We are trying to review our offerings based on the entry of new competition, and will present services that will compete head-to-head in the market. Our next move is to provide service offerings and bundle them with data, Internet and mobile.”

Omantel has faced tremendous difficulties in its ADSL network rollout because of the sultanate’s mountainous and rural terrain, as well as the dispersed population. Al-Wohaibi expects the second fixed licensee will have a distinct advantage in this respect, having received a WiMAX licence – 50MHZ in the 2.3 band – allowing it to circumvent having to dig and lay cables, as the incumbent has had to do.

“In our case, people are scattered across the country in remote locations. As a service provider we go all the way to access them – just one customer – which is both slow and costly,” Al-Wohaibi states. “We have approached the TRA to grant us WiMAX frequencies but until today, have not received a licence. The regulator has offered WiMAX to the second operator, which does not create a fair ground to compete.”

Al-Wohaibi beleives securing a WIMAX licence will help Omantel extend coverage to rural and remote areas of the country

Al-Wohaibi beleives securing a WIMAX licence will help Omantel extend coverage to rural and remote areas of the country

Al-Wohaibi also acknowledges that now that Nawras has been awarded the second fixed licence, it is a “completely different ballgame”. He thus expects Nawras to solidify its position and become a unified operator capable of providing fixed, mobile, Internet and international services in much the same way as Omantel, creating a market duopoly.

Change is also afoot at Omantel through the Ministry of Finance’s notice in July that the government would sell a further 25 per cent stake in Omantel to a strategic partner. This move would reduce the government’s stake in the telco to 45 per cent, with STC and Etisalat both indicating early interest.

While the Ministry of Finance has received non-binding bids and plans to finalise an agreement before the end of this year, the coinciding financial turmoil has setback the process. Not only would the purchaser have to contend with high interest rates for raising finance, but with the share price of Omantel having lost approximately 25 per cent of its value since July, it would not be in a favourable position for the Omani government to negotiate.

“The ministry genuinely wants to move on with the process and conclude the transaction, but it is reviewing the situation with the market and timing. At the moment there is high uncertainty [with respect to financial institutions and share prices] but if the market starts to recover, we may see things proceed.”

Omantel has enjoyed a bountiful harvest in the past year, with combined H108 net profits soaring 54.3 per cent year-on-year to OMR74.8 million (US$194 million), on the back of growth in mobile and broadband services. Group revenue rose by 14.3 per cent to OMR121.36 million year-on-year.

First half results did not include the acquisition of a 56.8 per cent stake in Worldcall Telecom Limited, a unified CDMA operator in Pakistan, which cost Omantel OMR73.559 million to acquire. Worldcall provides an extensive network of fixed payphones, prepaid calling cards, year cable television and Internet over cable. The deal was announced in February and concluded in May. Worldcall gives the Omani telco exposure to the world’s sixth most populous nation of 169 million, and access to Sri Lanka through a 70.65 per cent stake in Worldcall Telecom Lanka.

2 comments ↓

Yes.. it is all true! Omantel is the best telecom company in the GCC and soon it will be the best in the world. Oman broadband penetration is less than %0.5 right now and Omantel is the only broad band provider in the country since telecommunication started in Oman 38 years ago and this percentage will diffenetly improve in the next 30 years for the big demand of broadband!!! Wish you all the best Omantel CEO.

Omantel is in the process of merging back into being a single company after their disastrous decision in 2004 to split the company into two separate companies. After the completion of this process, Oman Mobile will not longer exist, most probably not even as a brand. All the company’s products will be sold as Omantel. Thankfully, Oman Mobile and its incredibly ugly logo and colors will disappear from existence. Omantel will rebrand with a new logo, supposedly by the first quarter of 2009.

Current market talk is that the government has differed the partial sale of their stake in the company to a strategic investor. Due to the current fall in the company’s stock price, the government feels that the offers they get will be too low. I am not sure how true the talk is of the government expecting 3 rials per share as the sale price.

I don’t understand how the company can go through so many changes, especially such as the new logo and branding, when at the same time it is being shopped around. Wouldn’t the new owners want a say on the branding?…

To continue reading and to view other comments on this story visit http://www.muscati.com/2008/12/change-at-omantel.html

Leave a Comment