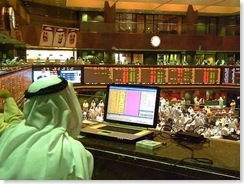

Kuwait’s third mobile network licensee, Kuwait Telecommunications Co. is reported to be seeking to raise as much as KWD25 million (US$93 million) in an initial public offering on the Kuwait Stock Exchange, commencing August 24. The company, in which Saudi Telecom Company (STC) will hold a 26 per cent stake, is selling 50 per cent of its capital in the IPO, which closes September 18. Only Kuwaiti nationals will be permitted to participate in the IPO.

50 per cent of the shares in the new operator will be offered to the Kuwaiti public between August 24 and September 18

Fuad Al-Hajeri, a member of the Kuwait Telecommunications Co’s founding committee is reported as saying he expects up to 700,000 Kuwaitis to buy shares in the company. ”We’re selling 250 million shares at 100 fils each, with 5 fils for service fees.”

STC won its stake in the licensee in November 2007, and Kuwait’s cabinet ratified the award in June this year. The new entrant is expected to launch operations before year-end.

The IPO is likely to be an early litmus test for the perceived viability of the new entrant, which faces an uphill struggle to carve out a business in a mobile market that comprises two accomplished performers – Zain and Wataniya. Numerous market commentators have questioned the prospects for a third entrant in a market with a population of fewer than 3.5 million.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment