The Middle East’s leading mobile operators have grown increasingly confident of their positions on a world stage, and have not been shy of detailing their goals in the short-term. With the third quarter earnings reporting period concluded, Comm. analyses how far the Middle East’s market leaders are away from achieving their stated ambitions.

Smiling all the way to the bank- Etisalat’s chairman, Mohammed Omran knows the company has deep enough pockets to fuel its growth projections

Smiling all the way to the bank- Etisalat’s chairman, Mohammed Omran knows the company has deep enough pockets to fuel its growth projections

As the fortunes of communications providers in the Middle East and Africa have risen in the past four years, so too has the articulation of their ambitions going forward. Zain, Etisalat and Qtel have been amongst the most vocal of players with respect to articulating what they are aiming to achieve in the coming years, and below Comm. considers whether they are on the right path to achieving them.

Etisalat

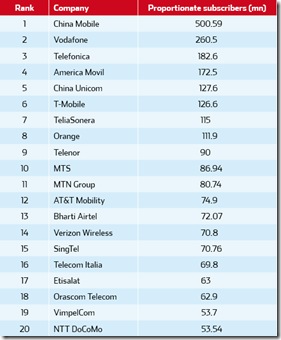

Stated ambition: “To become one of the top 10 operators by 2010.”

Present situation: Etisalat’s chairman believes the UAE telco is on track to reach 100 million subscribers by 2010, up from 74 million as of end-September 2008, and representing a growth rate of 22 per cent over the next two-and-a-quarter years.

Speaking in Dubai recently, Mohammad Omran commented that the telco is in its strongest position ever and is on course to achieve its goal of becoming one of the top 10 operators in the world by 2010.

Earlier in October Etisalat reported its consolidated financial results for the third quarter of 2008, showing significant growth in revenues, profits and subscriber numbers. The company reported AED 2.1 billion (US$572 million) in group net profits for the third quarter – an increase of 19 per cent year-on-year. This performance took net profits for the first nine months of 2008 to AED 7.3 billion.

Etisalat recorded net revenues of AED 6.6 billion for the third quarter of 2008 and AED 19.1 billion in total for the first nine months of the year. This represented an increase of 24 per cent, compared to the third quarter of 2007.

“Our acquisition in India has opened yet another key market, which will help power Etisalat’s growth,” commented Omran, referring to Etisalat’s acquisition of a 45 per cent stake in Swan Telecom in India for US$900 million in September.

Perspective: Etisalat is a hugely profitable organisation that has the financial resources to enter the emerging market’s most significant countries. With a presence in markets such as Nigeria, Egypt and Saudi Arabia, Etisalat has access to phenomenal addressable markets, which could indeed see it add the 26 million subscribers it requires by 2010 in order for it to reach its 100 million subscriber target.

Intensifying competition in many of its markets is likely to be one of the largest constraints to Etisalat’s progress, given the impact the competition is likely to have on subscriber growth and general top-line performance.

Zain

Stated ambition: “Through implementation of the ACE strategy, Zain’s goals by the year 2011 are to attain a US$6 billion EBITDA exceeding 150 million customers and to become one of the top 10 leading telecoms companies in the world by market capitalisation.”

Present situation: As of September 30, 2008, Zain operated on two continents and served over 56 million active customers (including Saudi Arabia). This represents an increase of 54 per cent compared to Q3-2007. The group offers its services in 22 countries with a total population of over 546 million under licence across Africa and the Middle East. On August 25, 2008 Zain launched its commercial services in Saudi Arabia.

Zain intends to launch services in Ghana before the end of the year, and following this development will have a presence in 22 countries, becoming the fourth largest mobile operator in the world in terms of geographic footprint.

The company’s customer increase was driven primarily by its high-growth African operations, Nigeria (61 per cent), Malawi (108 per cent) and Madagascar (132 per cent) in particular as well as solid growth in Iraq (125 per cent) and Bahrain (89 per cent). Of the 20 countries in which Zain operates, 13 subsidiaries are the leading operators whereas six other Zain operations are the solid number two in their respective markets.

Zain’s African operations represented 67 per cent of the group’s customer base while Middle East operations – Iraq, Bahrain, Sudan, Lebanon, Kuwait and Jordan – represented the remaining customers.

In percentage growth terms, Zain’s operation in Madagascar – Zain Madagascar – was the fastest growing operator of the Group, registering a 132 per cent increase in customers. The second largest growth was registered in Malawi (108 per cent), Chad (73 per cent) and Nigeria (61 per cent).

In total customer numbers, Celtel Nigeria represents 29 per cent of Zain Group’s customer base, followed by Iraq (15 per cent), Sudan (8 per cent), Tanzania (6 per cent) and DRC (5.5 per cent) as of Q3-2008.

All in all, Zain’s African operations registered a 49 per cent increase in customers in Q3-2008, while the Middle Eastern operations registered a 57 per cent increase over the same period.

Financially, Zain reported that consolidated revenues stood at US$ 5.37 billion, an increase of US$ 1.1 billion compared to the first nine months of 2007. This top line result reflects Zain’s growing customer base and the increasing coverage in Africa. Zain Group

EBITDA reached US$2.069 billion, a 19 per cent increase compared to the same period of 2007.

Consolidated net profits stood at US$ 878 million, an increase of 7 per cent compared to the first nine months of 2007.

Perspective: Zain has probably been the most vocal of the all Middle East operators of its ambition to become a leading communications provider and amongst the first to articulate the strategy that it expects to help achieve it. Zain’s goals are perhaps the most ambitious amongst its peers, and will likely depend on a large proportion of inorganic growth in order to meet its goals.

This is precisely what the operator looks set to do. Speaking at the Reuters Middle East Investment Summit earlier this month, Zain CEO Saad Al Barrak said his company was looking at investment opportunities in South Africa, Rwanda, Cote d’Ivoire, Mali. Mozambique, Yemen, Syria and Zimbabwe. He added that fresh from a capital raising exercise that generated US$4.5 billion, Zain would be looking to invest between US$3-US$4 billion in acquisitions in the coming 12 months.

Qtel:

Stated ambition: “To be among the top 20 telecommunications companies in the world by the year 2020.”

Present situation: In the first nine months of 2008, Qtel achieved record revenues of QR 14.27 billion (US$3.92 billion). The group’s net profit for the same period reached QR 1.83 billion, representing more than any full year net profit to date, and registering 41 per cent year-on-year growth. The group’s consolidated customers grew to a record 55.7 million representing an increase of 287 per cent over the same period in 2007.

In the third quarter of 2008, Qtel’s consolidated group revenue grew 113 per cent to QR 6.16 billion as a result of strong returns from across its regional operations. EBITDA increased 115 per cent in the third quarter of 2008 compared to the same period last year, and stood at QR 2.95 billion. Net profit for the quarter amounted to QR 651 million and represented a 58 per cent increase over the same period a year earlier. The third quarter of 2008 also saw the first full quarterly results from Indosat consolidated into the Qtel Group’s financial statements.

Based on results from the first nine months of 2008, Qtel’s six largest markets by revenue are Qatar, Indonesia (post acquisition), Kuwait, Iraq, Algeria and Tunisia contributing 28 per cent, 17 per cent 16 per cent, 14 per cent, 9 per cent and 7 per cent respectively.

Qtel said it remained confident of the growth prospects of each of these major markets, as well as the potential for development of other high-growth markets such as Palestine.

Perspective: Qtel has taken substantial steps forward in the last two years or so since announcing the acquisition of a 25 per cent stake in ST Telemedia’s Asia Mobile Holdings (AMH) in January 2007. Qtel CEO Nasser Marafih has always been a pragmatist of the highest order, and in the years between Qtel’s participation in the award of Oman’s second mobile licence in 2004, and the acquisition of AMH more than two years later, Marafih always contended that Qtel would bide its time and make smart investments when the opportunities arose.

Given the longer time-line to 2020, and limited detail offered by Qtel with respect to its operationsl targets, it appears feasible that the operator may in fact fulfil its ambitions ahead of time, given its record to date.

Source: ITU, company reports

NB: These figures should only be utilised as a guide, given they were reported at various times between end-2007 and September 2008

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment